Question: 12. CFA Examination Level III Emily Maguire, manager of the actively managed nongovernment bond portion of PTCs pension portfolio, has received a fact sheet containing

12. CFA Examination Level III Emily Maguire, manager of the actively managed nongovernment bond portion of PTC’s pension portfolio, has received a fact sheet containing data on a new security offering. It will be a bond issued by a U.S. corporation but denominated in Australian dollars (A$), with both principal and interest payable in that currency.

The terms of the offering made in June 1992 are as follows:

• Issuer—Student Loan Marketing Association (SLMA—a U.S. government sponsored corporation)

• Rating—AAA

• Coupon Rate—8.5 percent payable quarterly

• Price—par

• Maturity—June 30, 1997 (noncallable)

• Principal and interest payable in Australian dollars (A$)

As an alternative, Maguire finds that five-year U.S. dollar pay notes issued by SLMA yield 6.75 percent.

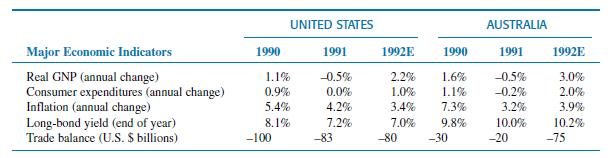

She prepares an analysis directed at several specific questions, beginning with the following table of economic data for Australia and the United States.

Assuming that interest rates fall 100 basis points in both the U.S. and Australian markets over the next year, identify which of these two bonds will increase the most in value, and justify your answer.

[7 minutes]

UNITED STATES AUSTRALIA Major Economic Indicators 1990 1991 1992E 1990 1991 1992E Real GNP (annual change) 1.1% -0.5% 2.2% 1.6% -0.5% 3.0% Consumer expenditures (annual change) 0.9% 0.0% 1.0% 1.1% -0.2% 2.0% Inflation (annual change) 5.4% 4.2% 3.4% 7.3% 3.2% 3.9% Long-bond yield (end of year) 8.1% 7.2% 7.0% 9.8% 10.0% 10.2% Trade balance (U.S. $ billions) -100 -83 -80 -30 -20 -75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts