Bern Zang is the chief investment officer of the Janson University Endowment Investment Office. The Janson University

Question:

Bern Zang is the chief investment officer of the Janson University Endowment Investment Office. The Janson University Endowment Fund (the “Fund”) is based in the United States and has current assets under management of $10 billion, with minimal exposure to alternative investments. Zang currently seeks to increase the Fund’s allocation to hedge funds and considers four strategies: dedicated short bias, merger arbitrage, convertible bond arbitrage, and global macro.

At a meeting with the Fund’s board of directors, the board mandates Zang to invest only in event-driven and relative value hedge fund strategies.

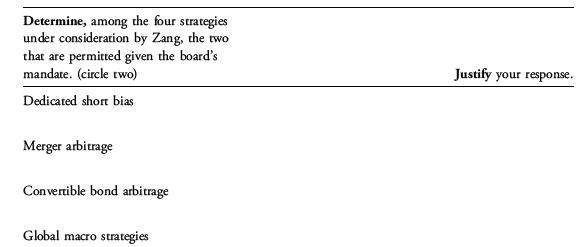

Determine, among the four strategies under consideration by Zang, the two that are permitted given the board’s mandate. Justify your response.

i. Dedicated short bias ii. Merger arbitrage iii. Convertible bond arbitrage iv. Global macro

Step by Step Answer: