Case 1: Noncallable, Nonconvertible, Perpetual Preferred Shares The following facts concerning the Union Electric Company 4.75 percent

Question:

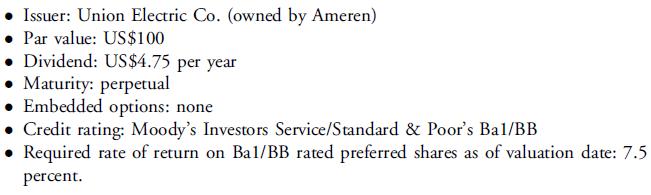

Case 1: Noncallable, Nonconvertible, Perpetual Preferred Shares The following facts concerning the Union Electric Company 4.75 percent perpetual preferred shares (CUSIP identifier: 906548821) are as follows:

A. Estimate the intrinsic value of this preferred share.

B. Explain whether the intrinsic value of this issue would be higher or lower if the issue were callable (with all other facts remaining unchanged).

Case 2: Retractable Term Preferred Shares Retractable term preferred shares are a type of preferred share that has been issued by Canadian companies. This type of issue specifies a “retraction date” when the preferred shareholders have the option to sell back their shares to the issuer at par value (i.e., the shares are “retractable” or “putable” at that date).2 At predetermined dates prior to the retraction date, the issuer has the option to redeem the preferred issue at predetermined prices (which are always at or above par value).

An example of a retractable term preferred share currently outstanding is YPG (Yellow Pages) Holdings, series 2, 5 percent first preferreds (TSX: YPG.PR.B).

YPG Holdings is Canada’s leading local commercial search provider and largest telephone directory publisher. The issue is in Canadian dollars. The shares have a $25 par value and pay a quarterly dividend of $0.3125 [= (5 percent × $25)/4]. As of 29 December 2008, shares were priced at $12.01 and carried ratings from Dominion Bond Rating Service (DBRS) and Standard & Poor’s of Pfd-3H and P3, respectively.

Thus, the shares are viewed by DBRS as having “adequate” credit quality, qualified by “H,” which means relatively high quality within that group. The shares are redeemable at the option of YPG Holdings in June 2009 at $26.75, with redemption prices eventually declining to par value at later dates. The retraction date is 30 June 2017, or eight and one-half years (34 quarters) from the date (31 December 2008) the shares were being valued. Similarly rated preferred issues had an estimated nominal required rate of return of 15.5 percent (3.875 percent per quarter). Because the issue’s market price is so far below the prices at which YPG could redeem or call the issue, redemption is considered to be unlikely and the redemption option is assumed here to have minimal value for an investor.

A. Assume that the issue will be retracted in June 2017; the holders of the shares will put the shares to the company in June 2017. Based on the information given, estimate the intrinsic value of a share.

Step by Step Answer:

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard