Consider price quotes and characteristics for two different bonds: At the same time, you observe the spot

Question:

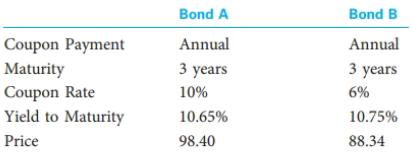

Consider price quotes and characteristics for two different bonds:

At the same time, you observe the spot rates for the next three years:

Demonstrate whether the price for either of these bonds is consistent with the quoted spot rates. Under these conditions, recommend whether Bond A or Bond B appears to be the better purchase.

Bond A Bond B Annual Annual Coupon Payment Maturity Coupon Rate Yield to Maturity 3 years 3 years 10% 6% 10.65% 10.75% Price 98.40 88.34

Step by Step Answer:

The essence of the answer is to price each bonds cash flows using ...View the full answer

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Your company assembles five different models of a motor scooter that is sold in specialty stores in the United States. The company uses the same engine for all five models. You have been given the...

-

Consider the customers visiting a Mega-Plex Movie Theater playing 18 different movies. Use this thought to illustrate both market segmentation and product differentiation. How do these two...

-

Consider two bonds with $1,000 face values that carry coupon rates of 8%, make annual coupon payments, and exhibit similar risk characteristics. The first bond has 5 years to maturity whereas the...

-

The file CigaretteTax contains the state cigarette tax ($) for each state as of January 1, 2013. a. Construct an ordered array. b. Plot a percentage histogram. c. What conclusions can you reach about...

-

What are the differences between piercing and blanking?

-

Disks A and B have masses M A and M B respectively. If they have the velocities shown, determine their velocities just after direct central impact. Given: MA = 2 kg MB = 4 kg e = 0.4 VAI = 2 VB1 = 5...

-

The four alternatives described below are being evaluated: The Incremental IRRs are: a. If the alternatives are independent, which one(s) should be selected if \(M A R R=15.5\) percent/year? b. If...

-

Bob Night opened "The General's Favorite Fishing Hole." The fishing camp is open from April through September and attracts many famous college basketball coaches during the off-season. Guests...

-

help me respond to this, Can I request a little insight on this zoom meetings attendees and the intended end result? Will this information conclusion be going back to the County auditors in a report?...

-

Consider the market for some product X that is represented in the following demand-and-supply diagram. For each of the legislated price controls listed in the next column, determine the price and...

-

Why does the discounted cash flow valuation equation appear to be more useful for the bond investor than for the common stock investor?

-

It is April 2, 2018, and you are considering purchasing an investment-grade corporate bond that has a $1,000 face value and matures on June 4, 2022. The bond's stated coupon rate is 4.60 percent, and...

-

Determine how your computer, or a computer in a lab to which you have access, is connected to others across a network. Is it linked to the Internet?

-

Joey bought five bags for a total discounted package price of 1,000 from his friend Liza, payable in 3 months. Which of the items below describes it as a form of an indivisible obligation? a. Joey...

-

Does an acquirer favor a control premium, and if so, why? Yes, because it is a fee they collect upon closing the transaction. Yes, because it reflects the additional value they will realize through...

-

The corporate assets in the financial report show cash flow. Lockheed Martin presents cash on the financial instrument table. The cash flow is presented at fair value. The income held by the company...

-

Short term debt owed to other companies with no formal debt instrument, typically for items already purchased by your company, is referred to as: A. Notes Payable B. Accounts Receivable C. Accounts...

-

Draw a typical business cycle. Label the peak, trough, downturn, and recovery. Also, include a growth trend line. Do economists know exactly where we are in the business cycle? How do economists use...

-

Indigo Books & Music Inc.'s (Indigo's) financial statements appear in Appendix A at the end of this book and on MyAccountingLab. Required 1. The financial statements are labelled "consolidated." What...

-

Briefly describe the following types of group life insurance plans: a. Group term life insurance b. Group accidental death and dismemberment insurance (AD&D) c. Group universal life insurance d....

-

You see an estimate that hourly wage rates will increase by 6 percent next year. What other information do you need to determine the effect of this wage rate increase on the operating profit margin,...

-

It is estimated that next year hourly wage rates will increase by 7 percent and productivity will increase by 5 percent. What would you expect to happen to unit labor cost? Discuss how this unit...

-

Assume that each of the following changes is independent (i.e., except for this change, all other factors remain unchanged). In each case, indicate what will happen to the earnings multiplier and...

-

(5) For each of the following sets with a binary operation, determine if it a group or not and explain why. If it is not a group, you should provide at least one of the properties which is not...

-

Solve 1. f(x) = ln(2x-1) 2. f(x)=(x-1) 5x3+x 3. f(x) = e+x = 3 4. f(x) = e 5. f(x)=(3x -2x+1) 6. f(x)=2x-2x+3 7. f(x)= 8. f(x) = 1 2x-1 1 (4x + x)

-

4. Assume that country A's saving level is fixed at SA = 10 and country B's saving level is fixed at SB 25. Except the saving level, these two countries share the same economic parameters. In every...

Study smarter with the SolutionInn App