Kloss Investments is an investment adviser whose clients are small institutional investors. Muskogh Charitable Foundation (the Foundation)

Question:

Kloss Investments is an investment adviser whose clients are small institutional investors.

Muskogh Charitable Foundation (the “Foundation”) is a client with $70 million of assets under management. The Foundation has a traditional asset allocation of 65% stocks/35%

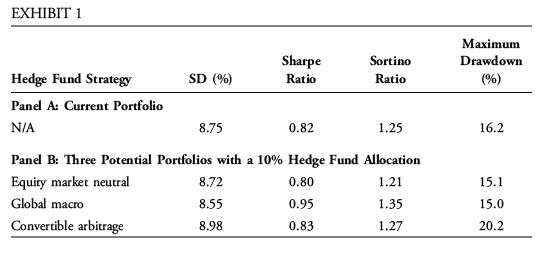

bonds. Risk and return characteristics for the Foundation’s current portfolio are presented in Panel A of Exhibit 1.

Kloss’ CIO, Christine Singh, recommends to Muskogh’s investment committee that it should add a 10% allocation to hedge funds. The investment committee indicates to Singh that Muskogh’s primary considerations for the Foundation’s portfolio are that any hedge fund strategy allocation should:

a) limit volatility,

b) maximize risk-adjusted returns, and

c) limit downside risk.

Singh’s associate prepares expected risk and return characteristics for three portfolios that have allocations of 60% stocks, 30% bonds, and 10% hedge funds, where the 10%

hedge fund allocation follows either an equity market-neutral, global macro, or convertible arbitrage strategy. The risk and return characteristics of the three portfolios are presented in Panel B of Exhibit 1.

Step by Step Answer: