When the annualied monthly percentage rates of return for a stock market index were regressed against the

Question:

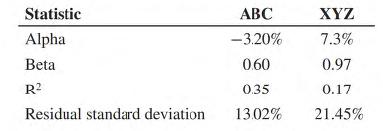

When the annualied monthly percentage rates of return for a stock market index were regressed against the returns for ABC and XYZ stocks over a 5-year period ending in 2013, using an ordinary least squares regression, the following results were obtained:

Explain what these regression results tell the analyst about risk- return relationships for each stock over the sample period. Comment on their implications for future risk-return relationships, assuming both stocks were included in a diversified common stock portfolio, especially in view of the following additional data obtained from two brokerage houses, which are based on 2 years of weekly data ending in December 2013.

Step by Step Answer:

Investments

ISBN: 9781259271939

9th Canadian Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus, Lorne Switzer, Maureen Stapleton, Dana Boyko, Christine Panasian