With respect to the capital asset pricing model, if the expected market risk premium is 6% and

Question:

With respect to the capital asset pricing model, if the expected market risk premium is 6% and the risk-free rate is 3%, the expected return for Security 1 is closest to:

A. 9.0%.

B. 12.0%.

C. 13.5%.

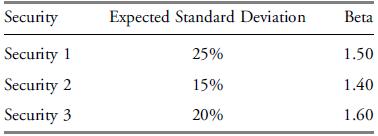

Use the following data to answer question:

An analyst gathers the following information:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard

Question Posted: