Question:

Consider a plain vanilla interest rate swap where party A agrees to make six yearly payments to party \(B\) of a fixed rate of interest on a notional principal of \(\$ 10\) million and in exchange party B will make six yearly payments to party A at the floating short rate on the same notional principal. Assume that the short rate process is described by the lattice of Example 16.1.

(a) Set up a lattice that gives the value of the floating rate cash flow stream at every short rate node, and thereby determine the initial value of this stream.

(b) What fixed rate of interest would equalize both sides of the swap?

Transcribed Image Text:

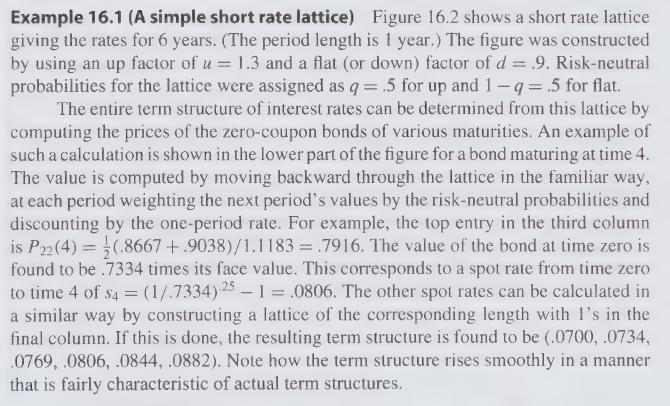

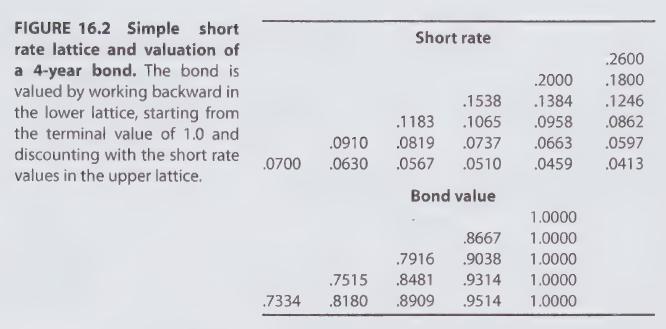

Example 16.1 (A simple short rate lattice) Figure 16.2 shows a short rate lattice giving the rates for 6 years. (The period length is 1 year.) The figure was constructed by using an up factor of u = 1.3 and a flat (or down) factor of d = .9. Risk-neutral probabilities for the lattice were assigned as q = .5 for up and 1-q= .5 for flat. The entire term structure of interest rates can be determined from this lattice by computing the prices of the zero-coupon bonds of various maturities. An example of such a calculation is shown in the lower part of the figure for a bond maturing at time 4. The value is computed by moving backward through the lattice in the familiar way, at each period weighting the next period's values by the risk-neutral probabilities and discounting by the one-period rate. For example, the top entry in the third column is P22(4)=(.8667+.9038)/1.1183= .7916. The value of the bond at time zero is found to be .7334 times its face value. This corresponds to a spot rate from time zero to time 4 of $4 = (1/.7334) 25-1=.0806. The other spot rates can be calculated in a similar way by constructing a lattice of the corresponding length with I's in the final column. If this is done, the resulting term structure is found to be (.0700, .0734, .0769, .0806, .0844, .0882). Note how the term structure rises smoothly in a manner that is fairly characteristic of actual term structures.