For a derivative of an asset that follows standard geometric Brownian motion, it may be useful to

Question:

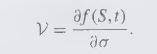

For a derivative of an asset that follows standard geometric Brownian motion, it may be useful to find the sensitivity of the derivative price with respect to a parameter of the underlying process. In particular, for the parameter \(\sigma\) the corresponding sensitivity is termed vega and is

For a call option on stock that follows geometric Brownian motion there holds \(\mathcal{V}=S \sqrt{T} N^{\prime}\left(d_{1}\right)\), where \(d_{1}\) is given by equation \((15.16 b)\). What is vega for the corresponding put option?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: