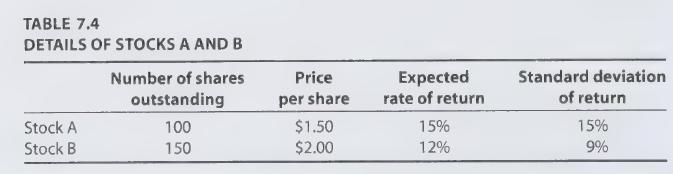

In Simpleland there are only two risky stocks, A and B, whose details are listed in Table

Question:

In Simpleland there are only two risky stocks, A and B, whose details are listed in Table 7.4.

Furthermore, the correlation coefficient between the returns of stocks $A$ and $B$ is $ho_{A B}=\frac{1}{3}$. There is also a risk-free asset, and Simpleland satisfies the CAPM exactly.

(a) What is the expected rate of return of the market portfolio?

(b) What is the standard deviation of the market portfolio?

(c) What is the beta of stock A?

(d) What is the risk-free rate in Simpleland?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: