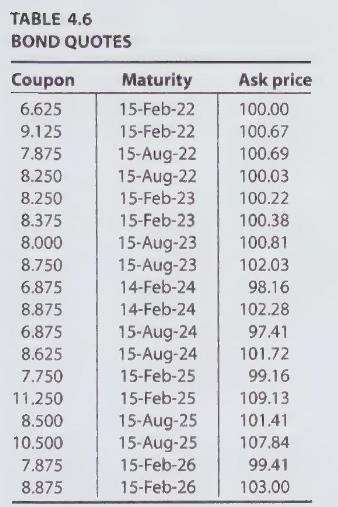

It is November 5 in the year 2012 . The bond quotations of Table 4.6 are available.

Question:

It is November 5 in the year 2012 . The bond quotations of Table 4.6 are available. Assume that all bonds make semiannual coupon payments on the 15 th of the month. Estimate the (continuous-time) term structure in the form of a 4th-order polynomial,

\[r(t)=a_{0}+a_{1} t+a_{2} t^{2}+a_{3} t^{3}+a_{4} t^{4},\]

where $t$ is time in units of years from today. The discount rate for cash flows at time $t$ is accordingly $d(t)=e^{-r(t) t}$. Recall that accrued interest must be added to the price quoted to get the total price. Estimate the coefficients of the polynomial by minimizing the sum of squared errors between the total price and the price predicted by the estimated term structure curve. Plot the curve and give the five polynomial coefficients.

Step by Step Answer: