Suppose that the adjustable-rate auto loan of Example 16.5 is modified by the provision of CAP that

Question:

Suppose that the adjustable-rate auto loan of Example 16.5 is modified by the provision of CAP that guarantees the borrower that the interest rate to be applied will never exceed \(11 \%\). What is the value of this loan to the bank?

Data from Example 16.5

Denise just graduated from college and has agreed to purchase a new automobile. She is now faced with the decision of how to finance the $10,000 balance she owes after her down payment. She has decided on a 5-year loan, but is given two choices: (A) a fixed-rate loan at 10% interest or (B) an adjustable-rate loan with interest that at any year is 2 points above the l-year T-bill rate at the beginning of that year. Currently the T-bill rate is 7%. She wants to know which is the better deal.

Denise is pretty adept with spreadsheet programs, so she does a little homework that night. First she decides that the T-bill rate can be modeled by the lattice that we used earlier. She decides to take the viewpoint of the bank and see what the two loans are worth to it. She makes the assumption that all payments are made annually, starting at the end of the first year.

The fixed-rate loan is easy. The payments are found by using the annuity formula in Chapter 3. Namely,

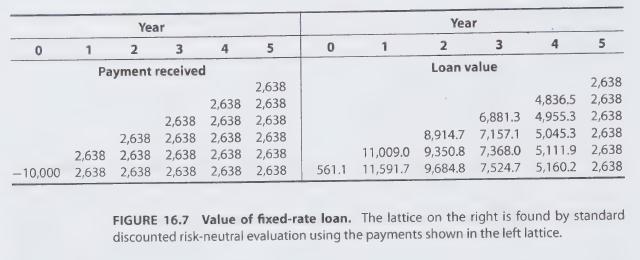

For P = $10,000, r = 10%, and n = S this yields A = $2,638, which is the annual payment. The cash flow at each node is shown on the lattice on the left side of Figure 16.7. The lattice on the right side of the figure shows the corresponding value of this cash flow computed using the interest rates. Denise concludes that the fixed-rate loan is worth $561.10 to the bank.

Step by Step Answer: