You are the manager of XYZ Pension Fund. On November 5, 2021, XYZ must purchase a portfolio

Question:

You are the manager of XYZ Pension Fund. On November 5, 2021, XYZ must purchase a portfolio of U.S. Treasury bonds to meet the fund's projected liabilities in the future.

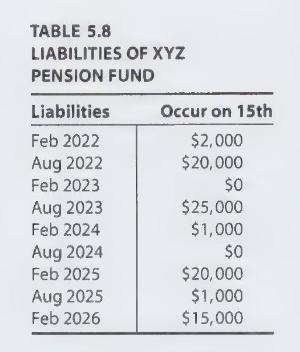

Short selling is not allowed. Following the procedure of the earlier exercise, a 4th-order polynomial estimate of the term structure is constructed as $r(t)=\alpha_{0}+\alpha_{1} t+\alpha_{2} t^{2}+\alpha_{3} t^{3}+\alpha_{4} t^{4}$. The liabilities of XYZ are as listed in Table 5.8.

(a) Construct a minimum-cost liability-matching portfolio by buying Treasury bonds assuming that excess periodic cash flows may be held only at zero interest to meet future liabilities.

(b) (Complex cash matching) Construct a minimum-cost liability-matching portfolio by buying Treasury bonds assuming that all excess periodic cash flows may be reinvested at the expected interest rates (implied by the current term structure) to meet future liabilities. No borrowing is allowed.

(c) (Duration matching) Construct a minimum-cost portfolio with present value equal to that of the liability stream. Immunize against a change in the term structure parameters. Do this for five cases. Case 1 is to guard against a change in $\alpha_{1}$, case 2 to guard against changes in $\alpha_{1}$ and $\alpha_{2}$, and so on.

Step by Step Answer: