Assume that an investor holds an S&P 100 Index option (OEX)the S&P 100 index consists of 100

Question:

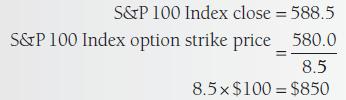

Assume that an investor holds an S&P 100 Index option (OEX)—the S&P 100 index consists of 100 stocks (capitalization weighted) from a broad range of industries. The strike price is 580, and the investor decides to exercise the option on a day that the S&P 100 index closes at 588.5. The investor will receive a cash payment from the assigned writer equal to $100 multiplied by the difference between the option’s strike price and the closing value of the index, or

The multiplier for this index option is $100 one point $100. The multiplier performs a function similar to the unit of trading (100 shares) for a stock option in that it determines the total dollar value of the cash settlement. Since options on different indexes may have different multipliers, it is important to know the multiplier for the stock index being used.

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen