Table 181 shows the duration calculation for a 5 percent, fiveyear bond. The bond is priced at

Question:

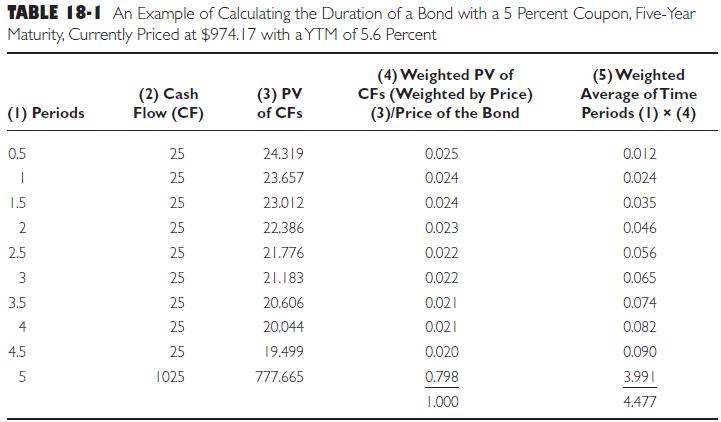

Table 18‐1 shows the duration calculation for a 5 percent, five‐year bond. The bond is priced at $974.17 because interest rates have risen so that the current Yield to Maturity (YTM) is 5.6 percent (semiannual yield, ytm, is 2.8 percent).

The cash flows, column 2, consist of ten $25 coupons (the annual coupon is $50) plus the return of principal at the end of the fifth year. Column 3 shows the present value of the cash flows using 2.8 percent as the discount rate. Column 4 shows the weights, or the present value of the cash flows as a percentage of the bond’s price, which in this example is $974.17. Notice that the final cash flow of $1,025 ($25 coupon plus $1,000 return of principal) accounts for 79.8 percent of the value of the bond on a weighted average basis. Column 5 is calculated by multiplying the weights in column 4 (which sum to 1.0) by the time periods in column 1 and summing these products. The end result, 4.48 years, is the present‐value weighted average number of years over which investors receive cash flows from the bond, which is the bond’s duration.

The duration of 4.48 years is approximately one‐half year less than the term to maturity of 5 years.

Table 18‐1

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen