a. Greg was born on July 31, 1980. He is the only child of Bill and Karen.

Question:

a. Greg was born on July 31, 1980. He is the only child of Bill and Karen. Under the terms of their separation agreement, which becomes effective on December 5, 1995, Bill is to have custody of Greg, and Karen is to pay him $4,000 a month in alimony. The agreement specifies that “none of the alimony is to be used for child support.” On April 15, 1998, the alimony payment is to be reduced to $2,200 a month. What will be deductible in 1998?

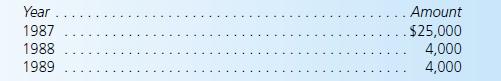

b. Millie pays Paul the following amounts of alimony under the terms of her 1987 divorce decree:

What amounts, if any, must be recaptured?

c. Under a 1989 separation agreement and divorce decree, Helen transfers a building she solely owns to her ex-husband, Ken, in exchange for his release of any rights he has in other property that Helen acquired during the marriage.

The transfer is made on the day of the divorce. Helen had bought the building in 1986 for $1,000,000. In 1987, she made $200,000 worth of capital improvements in the building. Its fair market value on the date she transfers it to Ken is $1,500,000. A week later, however, the market crashes, and Ken is forced to sell the building for $800,000. What are the tax consequences of these transactions?

d. Dan and Karen are negotiating a separation agreement in contemplation of a divorce that they expect to occur within six months of today’s date. Karen wants $1,000 a month in alimony, and she wants Dan to pay all of her legal fees. Dan agrees to do so. Assume that there will be no difficulty deducting the $1,000 a month under the alimony rules. Dan would also like to deduct what he pays for her legal fees, which are anticipated to be $12,000, of which $3,000 will be for obtaining alimony from Dan. What options exist for Dan?

Step by Step Answer:

Null Family Law Cases And Materials

ISBN: 9781599415741

5th Edition

Authors: Judith Areen , Milton C Regan