The Kraft Heinz Co. case was discussed in the chapter. To refresh your memory, on May 6,

Question:

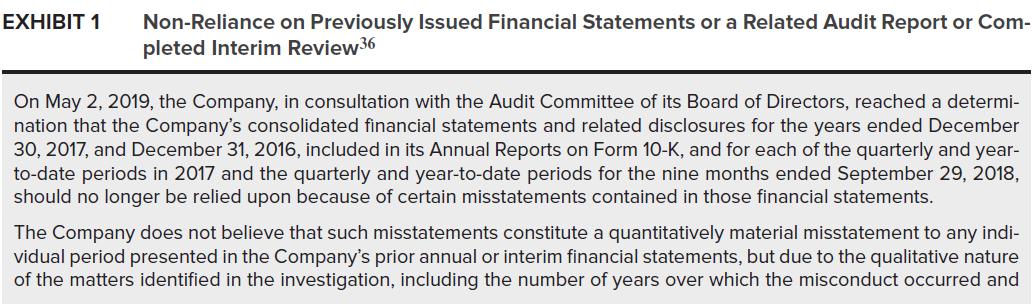

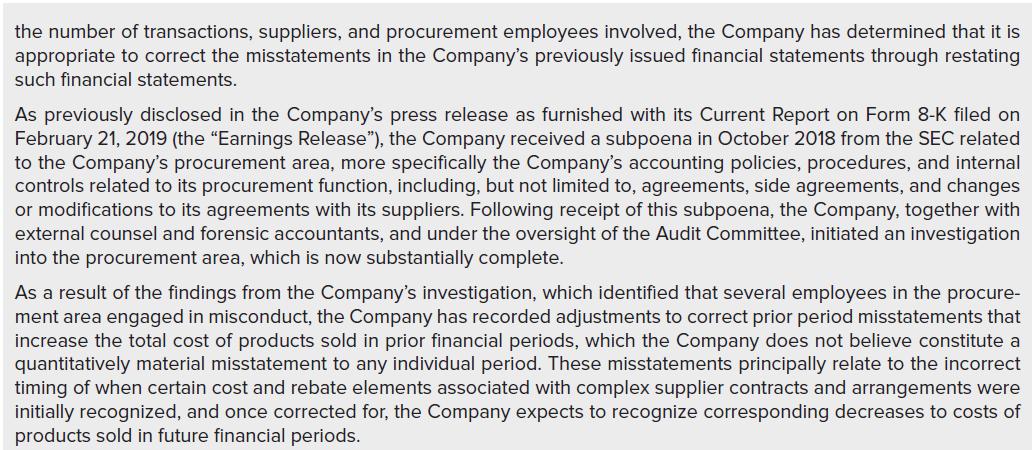

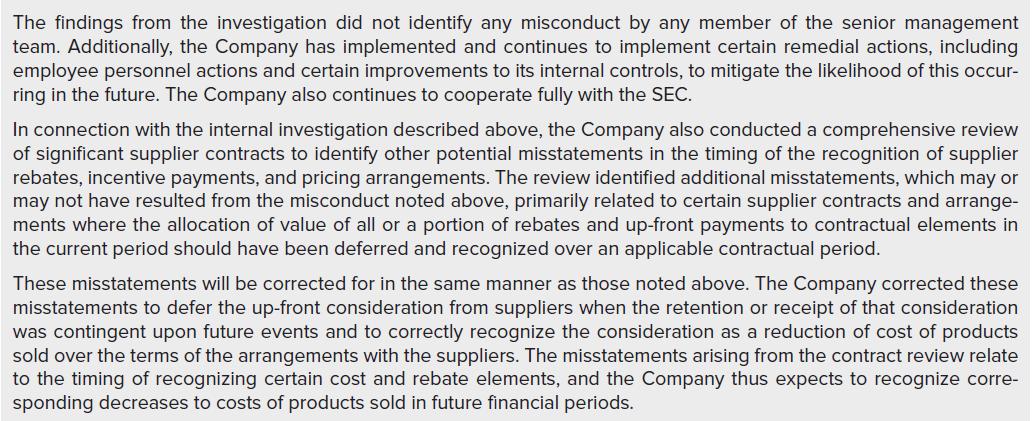

The Kraft Heinz Co. case was discussed in the chapter. To refresh your memory, on May 6, 2019, Kraft Heinz disclosed that it would restate its financial statements due to faulty procurement practices. The financial statements for 2016, 2017, and the first three quarters of 2018 were misstated because of inappropriate timing of the recognition of when certain cost and rebate elements associated with supplier contracts were initially recorded and then recognized through corresponding decreases to costs of products sold in future financial periods. The Form 8-K Report was filed with the SEC on May 2, 2019, pursuant to Items 2.02 and 4.02 of the Securities Exchange Act of 1934. The information in Exhibit 1 is taken from the Report.

Due to the findings above, the company said it would not be able to timely file its quarterly report for the period ended March 30, 2018.

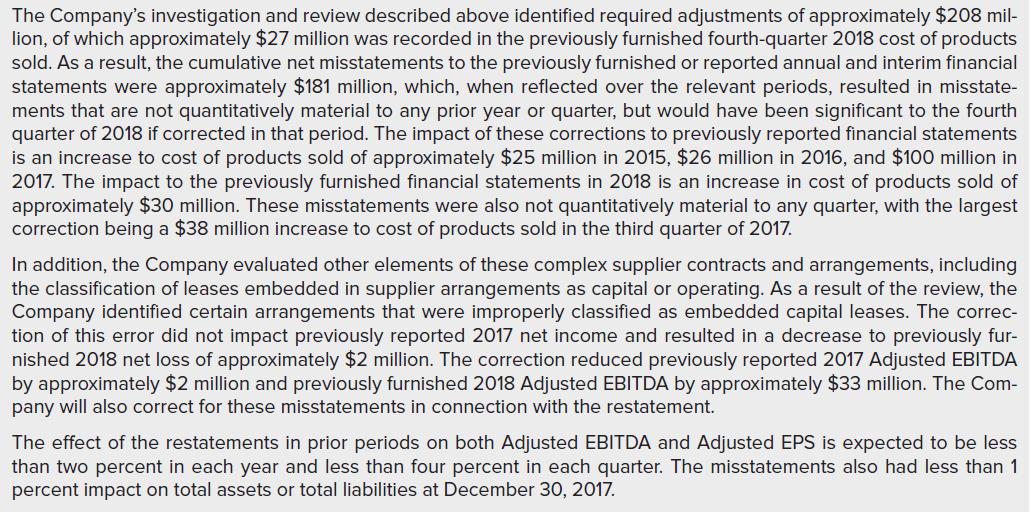

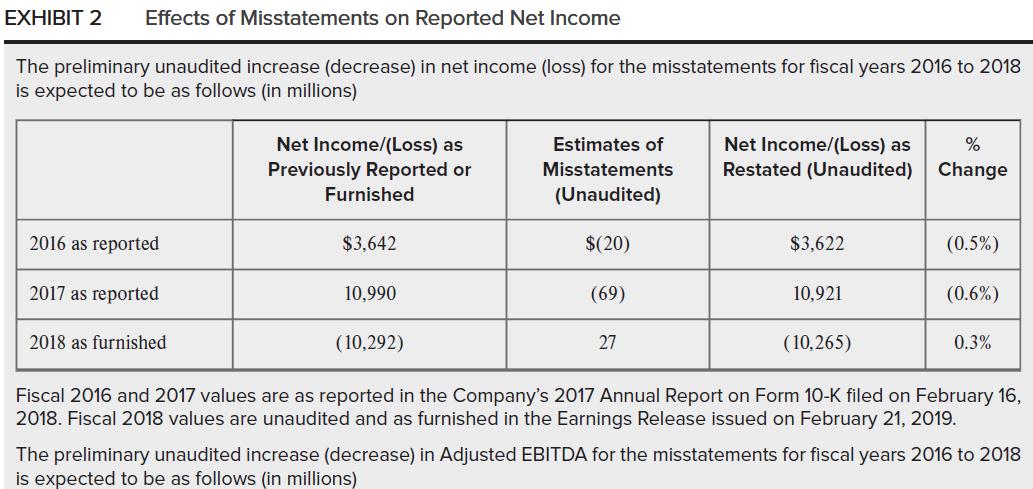

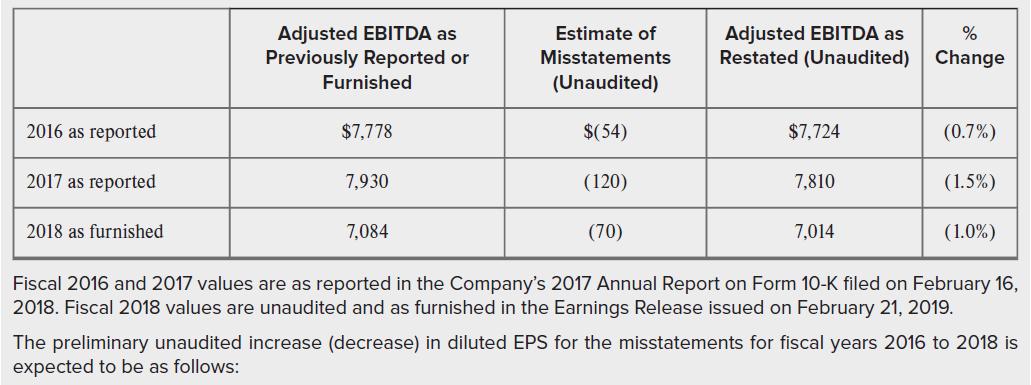

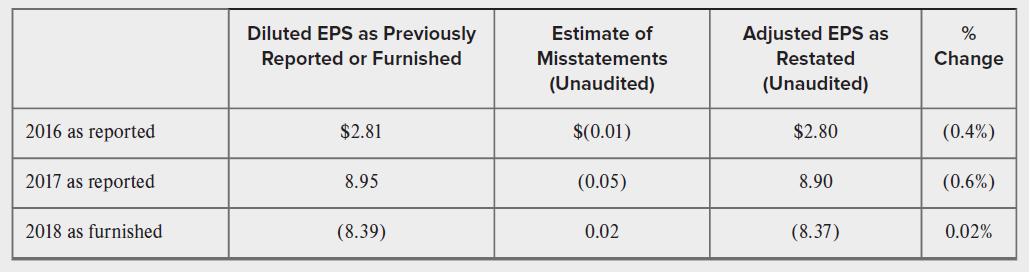

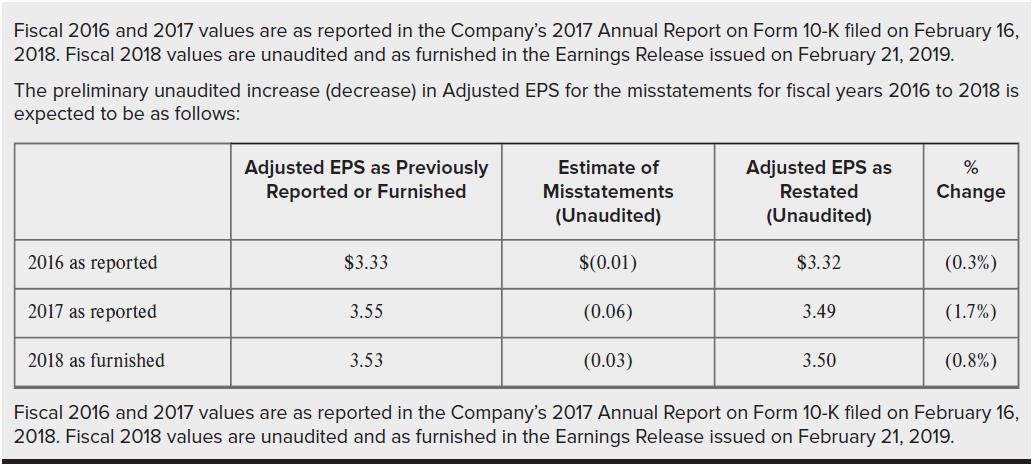

Exhibit 2 shows the preliminary estimated impact of misstatements for supplier rebates, capital leases, impairments, and other misstatements described in Exhibit 1. The tables illustrate the impact to net income/(loss), Adjusted EBITDA, diluted earnings per share (“diluted EPS”), and Adjusted EPS for 2016 and 2017 as compared to the previously reported financial statements as well as the impact of these metrics for 2018 as compared to the previously furnished financial statements in the Earnings Release issued on February 21, 2019. These misstatements and illustrated restated numbers are preliminary, unaudited, and subject to further change in connection with the completion of the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2018.

SEC Issues Two Subpoenas

In February 2019, buried in a press release announcing its 2018 Quarter 4 results, the company stated that it had received a subpoena from the SEC associated with an investigation into the company’s procurement area. It said the SEC was investigating its “accounting policies, procedures, and internal controls related to its procurement function, including, but not limited to, agreements, side agreements, and changes or modifications to its agreements with its vendors.” At that time Kraft Heinz said it was recording a $25 million increase to costs of products sold as an out of period correction as the Company determined the amounts were immaterial to the fourth quarter of 2018.

In the most recent SEC filing, the company also said it has received a second subpoena associated with its assessment of goodwill and intangible asset impairments, and that this subpoena also included document requests related to the procurement area.

“The Company is taking action to improve our policies and procedures and will continue to strengthen our internal financial controls,” said Michael Mullen senior vice president of corporate affairs at Kraft Heinz. “The findings from the investigation did not identify any misconduct by any member of the senior management team. We are pleased to report that the investigation is now substantially complete.”

Questions

1. Given the discussion in the chapter about reporting restatements of the financial statements to the SEC, explain why Kraft did not follow all the rules in reporting the numbers in Exhibit 2.

2. Comment on how the company addressed operational issues in its Form 8-K. What role did they play in deciding to restate the financial statements?

3. Are there any conclusions you can draw about the cause of misstatements at Kraft Heinz during the affected periods with respect to ethical leadership? Explain.

Step by Step Answer:

Ethical Obligations And Decision Making In Accounting Text And Cases

ISBN: 9781264135943

6th Edition

Authors: Steven Mintz