House prices and bubbles Houses can be thought of as assets with a fundamental value equal to

Question:

House prices and bubbles Houses can be thought of as assets with a fundamental value equal to the expected present discounted value of their future real rents.

a. Would you prefer to use real payments and real interest rates to value a house or nominal payments and nominal interest rates?

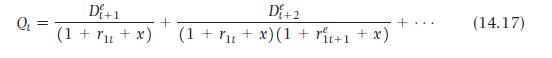

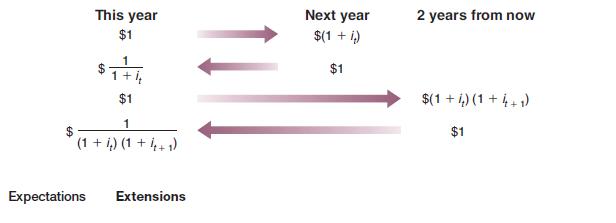

b. The rent on a house, whether you live in the house yourself and thus save paying the rent to an owner, or whether you own the house and rent it, is like the dividend on a stock. Write the equivalent of equation (14.17) for a house.

c. Why would low interest rates help explain an increase in the price-to-rent ratio?

d. If housing is perceived as a safer investment, what will happen to the price-to-rent ratio?

e. The Focus box "The Increase in U.S. Housing Prices: Fundamental or Bubble?" has a graph of the price-to-rent ratio. You should be able to find the value of the Case-Shiller home price index and the rental component of the consumer price index in the FRED economic database maintained at the Federal Reserve Bank of St. Louis (variables SPCS2ORSA and CUSROOOOSEHA respectively). The graph in Figure 1 in this Focus box ends in June 2015. Calculate the percentage increase in the home price index between June and the latest date available. Calculate the percentage increase in the rent price index from June 2015 to the latest date available. Has the price-to-rent ratio increased or decreased since June 2015?

Equation 14. 17

Figure 1

Step by Step Answer: