Taxes and transfers Recall that we define taxes, T, as net of transfers. In other words, [

Question:

Taxes and transfers Recall that we define taxes, T, as net of transfers. In other words,

\[

T=\text { Taxes }- \text { Transfer Payments }

\]

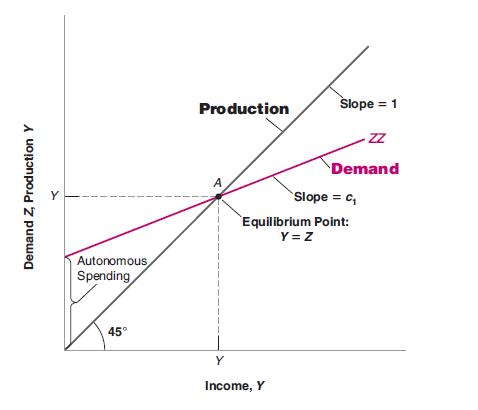

a. Suppose that the government increases transfer payments to private households, but these transfer payments are not financed by tax increases. Instead, the government borrows to pay for the transfer payments. Show in a diagram (similar to Figure 3-2) how this policy affects equilibrium output. Explain.

Figure 3-2

b. Suppose instead that the government pays for the increase in transfer payments with an equivalent increase in taxes. How does the increase in transfer payments affect equilibrium output in this case?

c. Now suppose that the population includes two kinds of people: those with high propensity to consume and those with low propensity to consume. Suppose the transfer policy increases taxes on those with low propensity to consume to pay for transfers to people with high propensity to consume. How does this policy affect equilibrium output?

d. How do you think the propensity to consume might vary across individuals according to income? In other words, how do you think the propensity to consume compares for people with high income and people with low income? Explain. Given your answer, do you think tax cuts will be more effective at stimulating output when they are directed toward high-income or toward low-income taxpayers?

Step by Step Answer: