Use the information in Table 17.2 to calculate the total federal income tax paid, the marginal tax

Question:

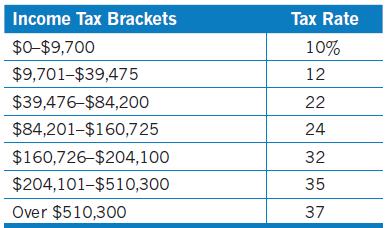

Use the information in Table 17.2 to calculate the total federal income tax paid, the marginal tax rate, and the average tax rate for people with the following incomes. (For simplicity, assume that these people have no exemptions or deductions from their incomes.)

a. $25,000

b. $125,000

c. $300,000

Data given in Table 17.2

Transcribed Image Text:

Income Tax Brackets $0-$9,700 $9,701-$39,475 $39,476-$84,200 $84,201-$160,725 $160,726-$204,100 $204,101-$510,300 Over $510,300 Tax Rate 10% 12 22 24 32 35 37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

To calculate the total federal income tax paid the marginal tax rate and the average tax rate for people with the given incomes youll need to apply th...View the full answer

Answered By

Deepak Pal

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students. Areas of interest: Business, accounting, Project management, sociology, technology, computers, English, linguistics, media, philosophy, political science, statistics, data science, Excel, psychology, art, history, health education, gender studies, cultural studies, ethics, religion. I am also decent with math(s) & Programming. If you have a project you think I can take on, please feel welcome to invite me, and I'm going to check it out!

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Use the information in Table 18.2 on page 602 to calculate the total federal income tax paid, the marginal tax rate, and the average tax rate for people with the following incomes. (For simplicity,...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

1. Identify the stage of the life cycle that best describes Cory and Tisha today. What important financial planning issues characterize this stage? 2. Based on the issues identified in Question 1 and...

-

Craig Industries was in the business of manufacturing charcoal. Craig, the corporation's president, contracted in the name of the corporation to sell the company's plants to Husky Industries. Craig...

-

Cosmo Industries recorded the following transactions for its first month of operations: Because Cosmo employs JIT, the company's CEO has asked how the accounting system could be simplified. a....

-

What is the focus of the $\mathrm{ABC}$ approach to cost allocation?

-

Do you think the advantages outweigh the disadvantages of the IoT? Explain.

-

At Reyes Company, checks are not prenumbered because both the purchasing agent and the treasurer are authorized to issue checks. Each signer has access to unissued checks kept in an unlocked file...

-

A/ Write a simple java code to calculate factorial of a number (100). B/Write a JAVA code to find the result (using for loop): 20 i=1 (6 marks.) (6 marks.)

-

An article in the New York Times observed: Income inequality is now significantly driven by well-paid college graduates marrying one another, and by poorly paid high school dropouts doing the same....

-

The federal government imposes a tax on sales of cigarettes. The federal Centers for Disease Control and Prevention compiled the data shown in the following table. Based on these data, is the federal...

-

Why would an organizational buyer want to get competitive bids? Identify and explain two situations when competitive bidding cannot be used.

-

The perfectly competitive model assumes that firms know when marginal revenue equals marginal costs. a. If a firm doesnt have this information, can it produce at the profit-maximizing level of...

-

Perfect competition is analytically elegant. a. What percentage of an economys total production do you think is provided by perfectly competitive firms? b. Based on your answer to a, why does the...

-

This chapter discusses perfect competition as a benchmark to think about the economy. a. Can labor market discriminationhiring someone on the basis of race or gender rather than capabilityexist in a...

-

Austrian economists observe that most lasting monopolies are the result of government and that any attempt to make government strong enough to control monopolies may result in an abuse of government...

-

Any large grocery store carries at least seven different kinds of corn chipsbaked, fried, salsa-flavored, white, yellow, blue, and lime-flavored. a. When is product differentiation real and when is...

-

Flextrola, Inc., an electronics systems integrator, is planning to design a key component for their next-generation product with Solectrics. Flextrola will integrate the component with some software...

-

Using Gauss-Jordan elimination, invert this matrix ONLY 0 0 0 0 1

-

According to Peter Heather, a historian at King's College London, during the time of the Roman Empire, the German tribes east of the Rhine River (the area the Romans called Germania) produced no...

-

The U.S. penny is made primarily of zinc. There have been several times in recent years when zinc prices have been high, and it has cost the U.S. Treasury more than one cent to manufacture a penny....

-

An article in the New York Times contains the statement: "Income is only one way of measuring wealth." Do you agree that income is a way of measuring wealth?

-

On an IQ test, the mean score is 100 with a standard deviation of 15. Letting X represent a randomly selected IQ score, write an expression that describes the probability of a randomly selected IQ...

-

1. Two long wires are a distance 4mm from each other the wire on the left carries a current of I = 5A and the wire on the right carries a current of I2 = 8A, find the magnetic field half way between...

-

what are the historical perspectives of astronomy ? How has astronomy changed since its inception (when it began)? How do we use that knowledge today? Who uses astronomy today? What do they use...

Study smarter with the SolutionInn App