An exchange rate crisis occurs when the peg (the fixed exchange rate) loses its credibility. Bond holders

Question:

An exchange rate crisis occurs when the peg (the fixed exchange rate) loses its credibility. Bond holders no longer believe that next period's exchange rate will be this period's exchange rate.

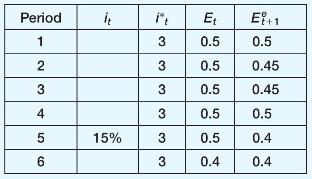

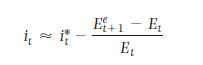

a. Solve the uncovered interest rate parity condition for the value of the domestic interest rate in period 1. (Use the approximate version of the uncovered interest parity relation in your calculations for all parts of this question below-equation 17.4).

b. In period 2, the crisis begins. Solve the uncovered interest rate parity condition for the value of the domestic interest rate in period 2 .

c. The crisis continues in period 3. However, in period 4, the central bank and government resolve the crisis. How does this occur?

d. Unfortunately, in period 5, the crisis returns bigger and deeper than ever. Has the central bank raised interest rates enough to maintain uncovered interest rate parity? What are the consequences for the level of foreign exchange reserves?

e. How is the crisis resolved in period 6? Does this have implications for the future credibility of the central bank and the government?

Data from equation 17.4

Step by Step Answer: