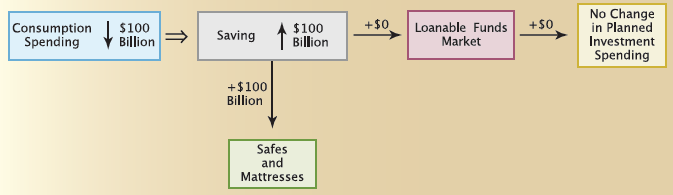

Question: In Figure 5(b), we assumed that when saving rises, none of the additional saving enters the loanable funds market. Suppose, instead, that 40 percent of

No Change in Planned Investment Spending +$0 Loanable Funds Market Consumption Spending $100 Billion $100 Billion Saving +$0 +$100 Billion Safes and Mattresses

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

If 40 of additional 100 billion savings is supplied to the loa... View full answer

Get step-by-step solutions from verified subject matter experts