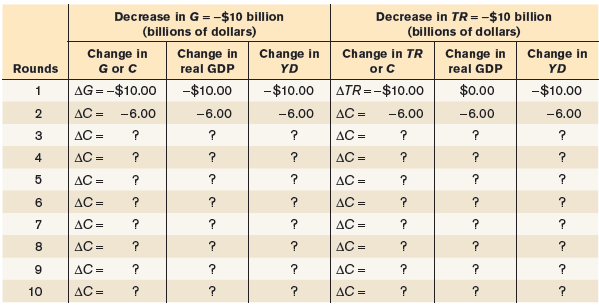

Show why a $10 billion reduction in government purchases of goods and services will have a larger

Question:

a. When government purchases decrease by $10 billion, what is the sum of the changes in real GDP after the 10 rounds?

b. When the government reduces transfers by $10 billion, what is the sum of the changes in real GDP after the 10 rounds?

c. Using the formula for the multiplier for changes in government purchases and for changes in transfers, calculate the total change in real GDP due to the $10 billion decrease in government purchases and the $10 billion reduction in transfers. What explains the difference? The multiplier for government purchases of goods and services is 1/(1 ˆ’ MPC). But since each $1 change in government transfers only leads to an initial change in real GDP of MPC × $1, the multiplier for government transfers is MPC/(1 ˆ’ MPC).

Step by Step Answer:

Macroeconomics

ISBN: 978-1319120054

3rd Canadian edition

Authors: Paul Krugman, Robin Wells, Iris Au, Jack Parkinson