Question: Using a figure similar to Figure 15A-1, explain how the money market and the loanable funds market react to a reduction in the money supply

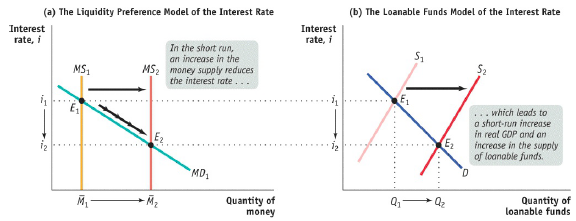

Using a figure similar to Figure 15A-1, explain how the money market and the loanable funds market react to a reduction in the money supply in the short run.

Figure 15A-1.

(a) The Liquidity Preference Model of the Interest Rate (b) The Loanable Funds Model of the Interest Rate Interest rate, i Interest rate, i In the short run, an increase in the MS2 money supply reduces MS, the interest rate... .. which leads to a short-run increase in real GDP and an increase in the supply of loanable funds. E2 E2 MD Quantity of money Quantity of loanable funds

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

In the accompanying diagram both the money market and the loanable funds market are i... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock