A European charity has an asset allocation at the beginning of the year consisting of the asset

Question:

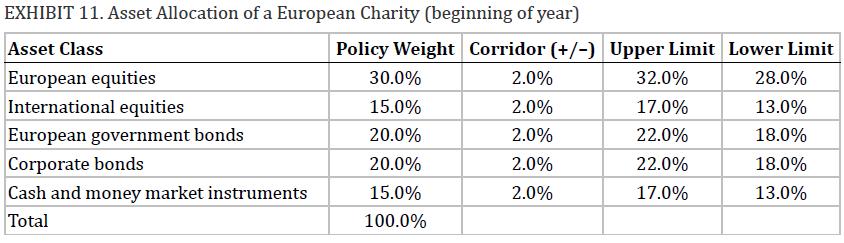

A European charity has an asset allocation at the beginning of the year consisting of the asset classes and weights shown in Exhibit 11.

As Exhibit 11 reveals, the charity has a policy that the asset class weights cannot deviate from the policy weights by more than 2 percent (the corridor). The resulting upper and lower limits for the asset class weights are shown in the rightmost columns of the table. There are two reasons for asset class actual weights to deviate from policy weights: by deliberate choice (tactical asset allocation or market timing) and as a result of divergence of the returns of the different asset classes (drift). In this example, the asset class weights start the year exactly in line with policy weights.

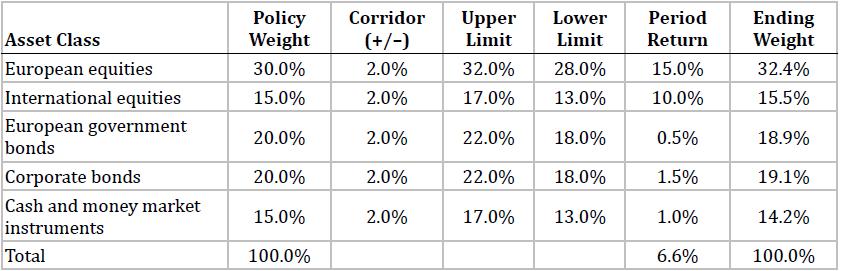

After half a year, the investment portfolio is as shown in Exhibit 12.

1. Discuss the returns of the portfolio and comment on the main asset weight changes.

2. How much of this return can be attributed to tactical asset allocation?

Step by Step Answer: