Based on the forecasted environment, liquidity planning should take into account that general partners may: A. call

Question:

Based on the forecasted environment, liquidity planning should take into account that general partners may:

A. call capital at a slower pace.

B. make distributions at a faster pace.

C. exercise an option to extend the life of the fund.

Kevin Kroll is the chair of the investment committee responsible for the governance of the Shire Manufacturing Corporation (SMC) defined benefit pension plan. The pension fund is currently fully funded and has followed an asset mix of 60% public equities and 40% bonds since Kroll has been chair.

Kroll meets with Mary Park, an actuarial and pension consultant, to discuss issues raised at the last committee meeting.

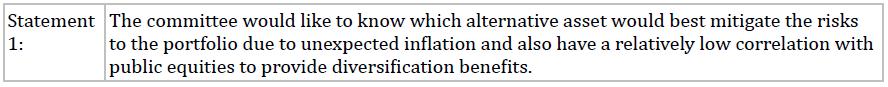

Kroll notes that the investment committee would like to explore the benefits of adding alternative investments to the pension plan’s strategic asset allocation. Kroll states:

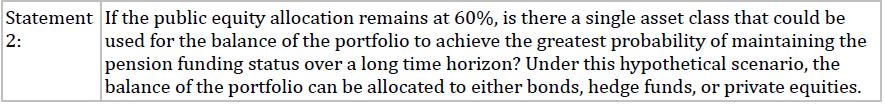

The SMC pension plan has been able to fund the annual pension payments without any corporate contributions for a number of years. The committee is interested in potential changes to the asset mix that could increase the probability of achieving the long-term investment target return of 5.5% while maintaining the funded status of the plan. Park notes that fixed-income yields are expected to remain low for the foreseeable future. Kroll asks:

Park confirms with Kroll that the committee has historically used a traditional approach to define the opportunity set based on distinct macroeconomic regimes, and she proposes that a risk-based approach might be a better method. Although the traditional approach is relatively powerful for its ability to handle liquidity and manager selection issues compared to a risk-based approach, they both acknowledge that a number of limitations are associated with the existing approach.

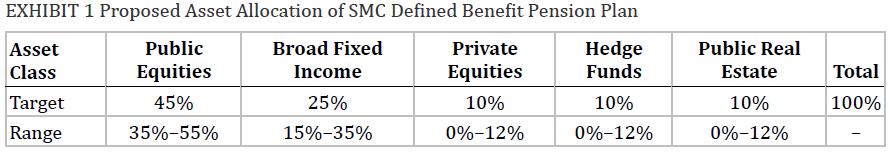

Park presents a report (Exhibit 1) that proposes a new strategic asset allocation for the pension plan.

Kroll states that one of the concerns that the investment committee will have regarding the new allocation is that the pension fund needs to be able to fund an upcoming early retirement incentive program (ERIP) that SMC will be offering to its employees within the next two years. Employees who have reached the age of 55 and whose age added to the number of years of company service sum to 75 or more can retire 10 years early and receive the defined benefit pension normally payable at age 65.

Kroll and Park then discuss suitability considerations related to the allocation in Exhibit 1. Kroll understands that one of the drawbacks of including the proposed alternative asset classes is that daily reporting will no longer be available. Investment reports for alternatives will likely be received after monthly or quarter-end deadlines used for the plan’s traditional investments. Park emphasizes that in a typical private equity structure, the pension fund makes a commitment of capital to a blind pool as part of the private investment partnership.

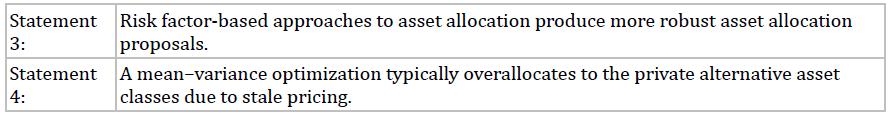

In order to explain the new strategic asset allocation to the investment committee, Kroll asks Park why a risk factor-based approach should be used rather than a mean–variance-optimization technique.

Park makes the following statements:

Park notes that the current macroeconomic environment could lead to a bear market within a few years. Kroll asks Park to discuss the potential impact on liquidity planning associated with the actions of the fund’s general partners in the forecasted environment.

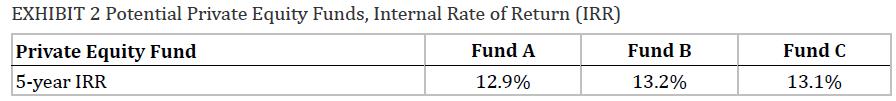

Kroll concludes the meeting by reviewing the information in Exhibit 2 pertaining to three potential private equity funds analyzed by Park. Park discloses the following due diligence findings from a recent manager search: Fund A retains administrators, custodians, and auditors with impeccable reputations;

Fund B has achieved its performance in a manner that appears to conflict with its reported investment philosophy; and Fund C has recently experienced the loss of three key persons.

Step by Step Answer: