Question: Discuss Smiths method for estimating the increase in return expectations derived from increasing the endowment allocation to private equity. Rob Smith, as portfolio manager at

Discuss Smith’s method for estimating the increase in return expectations derived from increasing the endowment allocation to private equity.

Rob Smith, as portfolio manager at Pell Tech University Foundation, is responsible for the university’s $3.5 billion endowment. The endowment supports the majority of funding for the university’s operating budget and financial aid programs. It is invested in fixed income, public equities, private equities, and real assets.

The Pell Tech Board is conducting its quarterly strategic asset allocation review. The board members note that while performance has been satisfactory, they have two concerns:

1. Endowment returns have underperformed in comparison to university endowments of similar size.

2. Return expectations have shifted lower for fixed-income and public equity investments.

Smith attributes this underperformance to a lower risk profile relative to its peers due to a lower allocation to illiquid private equity investments. In response to the board’s concerns, Smith proposes an increase in the allocation to the private equity asset class. His proposal uses option price theory for valuation purposes and is supported by Monte Carlo simulations.

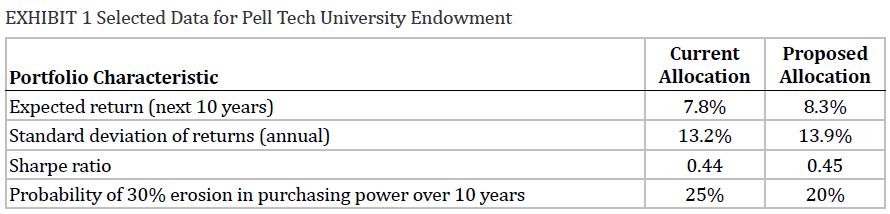

Exhibit 1 presents selected data on the current university endowment.

EXHIBIT 1 Selected Data for Pell Tech University Endowment Portfolio Characteristic Current Allocation Allocation Proposed Expected return (next 10 years) 7.8% 8.3% Standard deviation of returns (annual) 13.2% 13.9% Sharpe ratio 0.44 0.45 Probability of 30% erosion in purchasing power over 10 years 25% 20%

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Smiths Method for Estimating Increased Return from Private Equity Rob Smith likely proposes using a method based on the liquidity premium concept to e... View full answer

Get step-by-step solutions from verified subject matter experts