A restaurant company is considering further investment in order to increase its seating capacity. The company prepares

Question:

A restaurant company is considering further investment in order to increase its seating capacity.

The company prepares its accounts to 31 December each year and, if accepted, the proposed investment would be made on 1 January Year 9 and will become operational immediately.

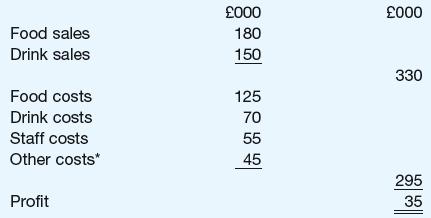

Based on the actual results for the year to date, the latest forecast income statement for the company for the year to 31 December Year 8 is as follows:

The proposed investment At present the restaurant is not able to exploit the growing demand from customers because it does not have sufficient seating capacity. The restaurant is considering the investment of £40,000 on 1 January Year 9. It is expected that this will increase the seating capacity of the restaurant by 30% compared to the present level. The lease of the current business premises ends at the end of Year 12. At that time the £40,000 investment will have no residual value. Of this total investment, £30,000 will qualify for 100% tax depreciation in Year 9 and the remainder will qualify for 20% tax depreciation per year, commencing in Year 9, calculated on a reducing balance basis. Any balancing tax charge will be made or allowance will be available at the end of Year 12.

Sales It is expected that the additional sales of food and drink will be proportional to the seating capacity increase and that the mix of food sales and drink sales will not change.

Costs It is expected that apart from the effects of inflation (see below):

l Food costs and drink costs will continue to be the same percentages of food sales and drink sales as they are in the forecast income statement shown above.

l Staff costs are step costs and are expected to increase by 20% from their forecast value for 2008 if there is any capacity increase.

l The variable element of other costs is expected to increase in proportion to the capacity increase; the fixed cost element is expected to increase by £10,000 if there is any capacity increase.

Inflation Cost inflation is predicted to be 4% per annum for each of the years Year 9 to Year 12 whereas selling prices are only expected to increase by 3% per annum during the same period.

Taxation The company pays tax on its profits at 20%. This is payable one year after the profit is earned.

Cost of capital The company’s post tax money cost of capital for evaluating this investment is 8% per annum.

Required:

(a) Prepare calculations to show whether the investment is worthwhile assuming that the 30% increase in seating capacity is fully utilised and recommend whether the investment should

(b) Calculate and interpret the Internal Rate of Return (IRR) of the proposed investment.

(c) Calculate the sensitivity of your recommendation to changes in the percentage capacity utilisation.

Step by Step Answer: