Matahari Ltd manufactures and installs renewable energy systems. It has four divisions in Australia: Wind, Thermal Solar,

Question:

Matahari Ltd manufactures and installs renewable energy systems. It has four divisions in Australia:

Wind, Thermal Solar, Photo Voltaic (PV) and Installation. The company was listed on the Australian Securities Exchange in 2013.

The CEO, William Smith, believes that divisional managers should be given a high degree of autonomy and held accountable for the performance of their divisions. He believes that if the divisions prosper then the company and its shareholders will prosper.

Before the beginning of each financial year, William reviews performance and then sets a returnon- investment (ROI) target for each division for the coming year. ROI is defined as the operating profit as a percentage of the book-value of the assets employed. Targets are set in consultation with the respective divisional manager with due regard to the prevailing market conditions. William makes sure that the ROI target is challenging but achievable. Over the past ten years, the ROI targets have tended to increase slightly each year. Key personnel within each division are awarded a performance bonus, if and only if, the ROI of that division exceeds the target.

For the past seven years, Matahari has been using a bonus and incentive scheme to motivate and reward key personnel. The scheme is based on the distribution of a bonus pool. The size of the bonus pool is 10 per cent of Matahari’s residual income for the year and is capped at $1.5 million per year.

The bonus pool is distributed to divisions on the basis of the ROI achieved by each division.

If a division does not reach its target, it does not receive a bonus. If a division achieves its target, it receives a bonus score equal to the division’s actual ROI less the division’s target ROI, up to a maximum of 5.00 points. The bonus pool is then distributed according to each division’s score relative to the total bonus score. The bonus awarded to a division is then distributed to key personnel as determined by the divisional manager.

William is disappointed that Chloe Lee, the manager of the PV Division, has not taken the opportunity to increase her division’s production capacity. The shareholders are supportive and would be happy to finance the expansion. William recalls that divisional managers have been reluctant to submit investment proposals on several occasions in the past.

William has also found himself starting to think more about the suitability of the bonus system and underlying performance measures. A member of William’s business network has suggested that Matahari would benefit from the adoption of a balanced scorecard. William gets nervous when people start talking about non-financial measures; he thinks his focus on a small number of key financial measures has worked well to date and aligns with shareholder interests.

Required

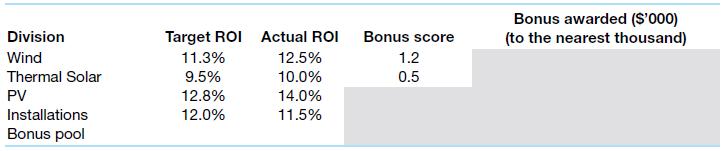

(a) For the year ended 30 June 2019, Matahari’s residual income was $13 939 000. The target and actual ROI’s for each division are given in the table below. Calculate the bonus awarded to each division by completing the table below.

(b) State two key strengths of the existing bonus plan.

(c) Identify one key weakness of the existing bonus plan and suggest a change that would alleviate the weakness.

Step by Step Answer:

Management Accounting

ISBN: 9780730369387

4th Edition

Authors: Leslie G. Eldenburg, Albie Brooks, Judy Oliver, Gillian Vesty, Rodney Dormer, Vijaya Murthy, Nick Pawsey