The Dancing Goat is a small coffee operation with ten cafes located around Melbourne. Each has a

Question:

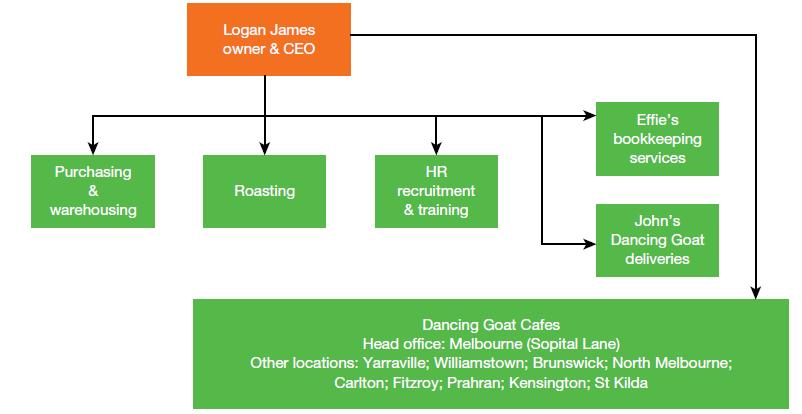

The Dancing Goat is a small coffee operation with ten cafes located around Melbourne. Each has a manager and up to five full-time employees to cover the 7.30 am to 4.30 pm, Monday to Saturday opening hours. Logan, the owner, employs a total of 60 full-time employees and three part-time employees (bookkeeper, roaster and delivery van driver). The company structure is outlined in figure 5.12.

The coffee beans are roasted at the main Sopital Lane cafe and transported daily to the other cafes. Logan makes all decisions in relation to coffee bean purchasing, roasting, retail pricing and product offerings. He also sets up regular coffee training sessions for all employees. Coffee prices are set at a premium ($4.00 per coffee). The cafes offer a deliberately small, but high-quality, gourmet menu (five types of specialty sandwiches made on the premises and unique Dancing Goat-inspired handmade cupcakes supplied by a local gourmet cupcake supplier). The 12 roasted coffee bean blends are also packaged in 250-gram bags, which retail at all the cafes for $12 per bag. Logan visits each of the cafes most days to chat with his managers and ensure operations are running smoothly.

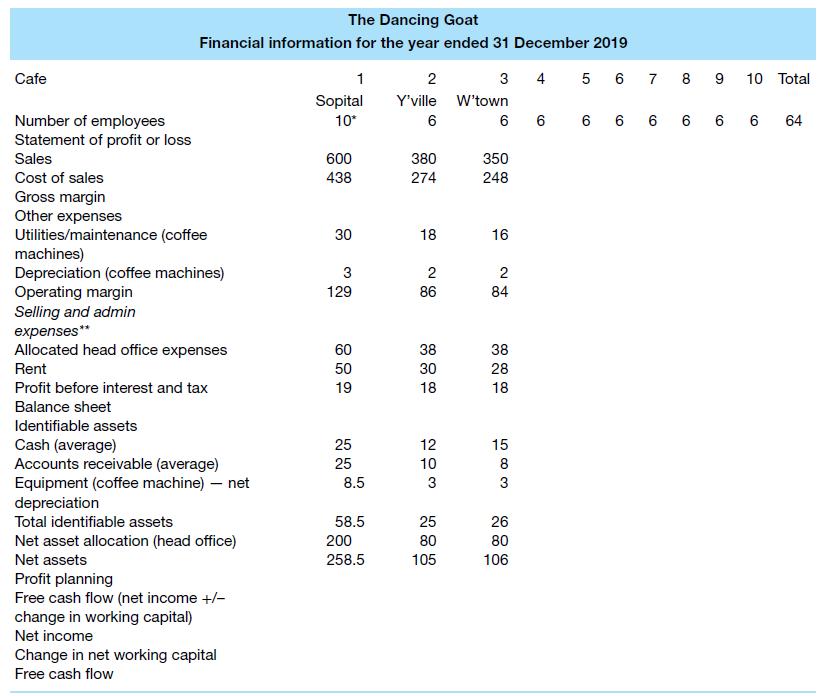

Logan arranges a meeting with a management accounting consultant to review the partially completed annual summary report (below).

Logan wants advice on how he might improve cash flow. Specifically, Logan wants to know how to increase profit performance and improve working capital. Logan and the consultant discuss the following matters.

• Inventory: Logan has recently handed the coffee inventory management over to Max, his Sopital cafe manager. While Max had been earning bonuses for keeping coffee prices down, Logan is concerned about the comments he has received from customers about the quality of their brew.

On investigation, Max has been approached by alternative suppliers offering coffee beans at significantly reduced cost. The new suppliers require larger order quantities and, as a result, inventory levels have increased.

• Accounts receivable: These are the accounts set up by local community businesses for businessentertaining purposes. Accounts receivable are minimal as they are generally settled, in full, at the end of each month.

• Accounts payable: These are probably stretched out as far out as they can be. Nevertheless, Max’s new fresh coffee bean suppliers are not offering the payment terms of the previous suppliers set up by Logan. This certainly requires further revision.

Logan wants to emphasise sales of high-margin products rather than the efficiency of operations. He is concerned that an efficiency focus will impact his niche marketing strategy for The Dancing Goat cafes.

(a) The management accounting consultant suggests they review the strategic budgeting or profit planning process at The Dancing Goat. Drawing on relevant aspects of the profit planning process and figure 5.2, describe the discussions they might have in planning for the success of The Dancing Goat.

(b) Assume Logan decides to introduce the Beyond Budgeting model at The Dancing Goat. Outline how the Beyond Budgeting model might work at The Dancing Goat.

Step by Step Answer:

Management Accounting

ISBN: 9780730369387

4th Edition

Authors: Leslie G. Eldenburg, Albie Brooks, Judy Oliver, Gillian Vesty, Rodney Dormer, Vijaya Murthy, Nick Pawsey