Question: Nandini Ltd. provides the following data: Comparative trial balance Notes: (a) The depreciation charged for the year was 60 lakh. (b) The book value of

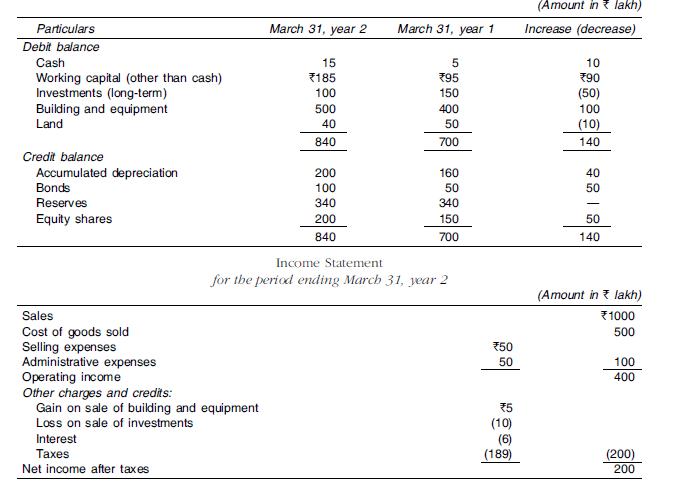

Nandini Ltd. provides the following data:

Comparative trial balance

Notes:

(a) The depreciation charged for the year was ₹60 lakh.

(b) The book value of the building and equipment disposed off was ₹10 lakh.

Prepare a cash flow statement (based on AS-3).

Particulars Debit balance Cash Working capital (other than cash) Investments (long-term) Building and equipment Land Credit balance Accumulated depreciation Bonds Reserves Equity shares Sales Cost of goods sold Selling expenses March 31, year 2 Administrative expenses Operating income Other charges and credits: Gain on sale of building and equipment Loss on sale of investments Interest Taxes Net income after taxes. 15 *185 100 500 40 840 200 100 340 200 840 March 31, year 1 5 795 150 400 50 700 160 50 340 150 700 Income Statement. for the period ending March 31, year 2 *50 50 75 (10) (6) (189) (Amount in lakh) Increase (decrease) 10 790 (50) 100 (10) 140 40 50 50 140 (Amount in lakh) 1000 500 100 400 (200) 200

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

3 Since there is no increase in reserves 340 lakh the entire net income after taxes of 200 lakh repr... View full answer

Get step-by-step solutions from verified subject matter experts