A company is deciding which of two alternative machines (X and Y) to purchase. The useful lives

Question:

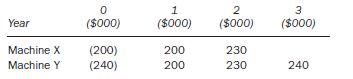

A company is deciding which of two alternative machines (X and Y) to purchase. The useful lives for machines X and Y are two years and three years respectively. The cash flows associated with each of the machines are given in the table below:

Each of the machines would be replaced at the end of its useful life by an identical machine. You should assume that the cash flows for the future replacements of machines X and Y are the same as those in the table above. The company’s cost of capital is 12 per cent per annum.

Required:

(a) Calculate, using the annualized equivalent method, whether the company should purchase machine X or machine Y.

(b) Explain the limitations of using the annualized equivalent method when making investment decisions.

Step by Step Answer: