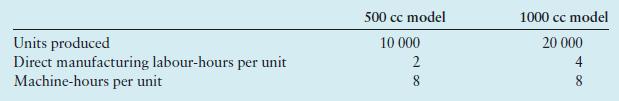

Azu-Cena Ltda is a manufacturer of motorcycles. Production and cost data for 2018 are as follows: A

Question:

Azu-Cena Ltda is a manufacturer of motorcycles. Production and cost data for 2018 are as follows:

A single cost pool is used for manufacturing overhead. For 2018, manufacturing overhead was €6.4 million. Azu-Cena allocates manufacturing overhead costs to products on the basis of direct manufacturing labour-hours per unit.

Azu-Cena’s accountant now proposes that two separate pools be used for manufacturing overhead costs:

• Machining cost pool (€3.6 million in 2018)

• General plant overhead cost pool (€2.8 million in 2018).

Machining costs are to be allocated using machine-hours per unit. General plant overhead costs are to be allocated using direct manufacturing labour-hours per unit.

Required

1. Calculate the overhead costs allocated per unit to each model of motorcycle in 2018 using the current single-cost-pool approach of Azu-Cena.

2. Calculate the machining costs and general plant overhead costs allocated per unit to each model of motorcycle assuming that the accountant’s proposal for two separate cost pools is used in 2018.

3. What benefits might arise from the accountant’s proposal for separate pools for machining costs and general plant costs?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan