Bart Mover, CPA, has been asked for advice by a client wishing to sell her home. The

Question:

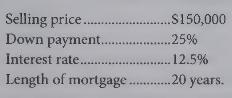

Bart Mover, CPA, has been asked for advice by a client wishing to sell her home. The client has found a buyer who has agreed to the following terms of sale:

However, the client's attorney has advised her that any interest rate in excess of 10 percent is usurious and should be avoided. The client will accept a 10 percent mortgage interest rate from the buyer, but would like to increase the selling price of the home by a corresponding amount.

{Required:}

Ignoring tax effects, by what amount should the selling price be increased to compensate Mover's client for the lower interest rate? (Hint: the monthly payment for a loan of \(\$ 1\) over 20 years at \(12.5 \%\) is \(\$ .0113615\); at \(10 \%\) it is \(\$ .0096504\).)

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline