Question: Intermediate: Backflush costing. (a) Explain the term backflush accounting and the circumstances in which its use would be appropriate. (6 marks) (b) CSIX Ltd manufactures

Intermediate: Backflush costing.

(a) Explain the term ‘backflush accounting’ and the circumstances in which its use would be appropriate. (6 marks)

(b) CSIX Ltd manufactures fuel pumps using a just-in-time manufacturing system which is supported by a backflush accounting system. The backflush accounting system has two trigger points for the creation of journal entries. These trigger points are:

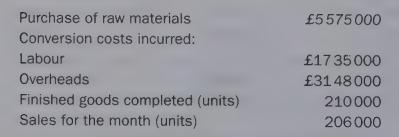

the purchase of raw materials the manufacture of finished goods The transactions during the month of November 2005 were as follows:

There were no opening inventories of raw materials, work in progress or finished goods at 1 November. The standard cost per unit of output is £48. This is made up of £26 for materials and £22 for conversion costs (of which labour comprises £8.20).

Required:

(i) Prepare ledger accounts to record the above transactions for November 2005. (6 marks) (ii) Briefly explain whether the just-in-time system operated by CSIX Ltd can be regarded as ‘perfect’. (3 marks)

ACCA Performance Measurement Paper 3.3

Purchase of raw materials 5575000 Conversion costs incurred: Labour 1735000 Overheads 3148000 Finished goods completed (units) 210000 Sales for the month (units) 206000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts