Question: Intermediate: Calculation of fixed and variable overhead rates, normal activity level and under/over recovery of overheads (a) C Ltd is a manufacturing company. In one

Intermediate: Calculation of fixed and variable overhead rates, normal activity level and under/over recovery of overheads

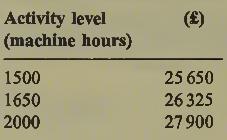

(a) C Ltd is a manufacturing company. In one of the production departments in its main factory a machine hour rate is used for absorbing production overhead. This is established as a predetermined rate, based on normal activity. The rate that will be used for the period which is just commencing is £15.00 per machine hour. Overhead expenditure anticipated, at a range of activity levels, is as follows:

Required:

Calculate:

(i) the variable overhead rate per machine hour;

(ii) the total budgeted fixed overhead;

(iii) the normal activity level of the depart¬ ment; and (iv) the extent of over/under absorption if actual machine hours are 1700 and expenditure is as budgeted.

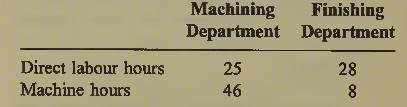

(b) In another of its factories, C Ltd carries out jobs to customers’ specifications. A particular job requires the following machine hours and direct labour hours in the two production departments:

Direct labour in both departments is paid at a basic rate of £4.00 per hour. 10% of the direct labour hours in the finishing department are overtime hours, paid at 125% of basic rate. Overtime premiums are charged to production overhead.

The job requires the manufacture of 189 com¬ ponents. Each component requires 1.1 kilos of prepared material. Loss on preparation is 10% of unprepared material, which costs £2.35 per kilo.

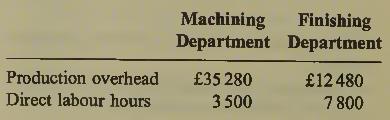

Overhead absorption' rates are to be established from the following data:

![]()

Required:

(i) Calculate the overhead absorption rate for each department and justify the absorption method used.

(ii) Calculate the cost of the job.

Activity level (machine hours) 1500 () 25 650 1650 26325 2000 27 900

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts