Taylor Company makes a variety of furniture. It is organized in two divisions, Office and Home. Home

Question:

Taylor Company makes a variety of furniture. It is organized in two divisions, Office and Home.

Home Division normally sells to outside customers but, on occasion, also sells to the Office Division.

When it does, corporate policy states that the price must be cost plus 20 percent to ensure a “fair” return to the selling division. Home received an order from Office Division for 300 units.

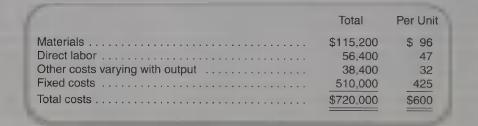

Home’s planned output for the year had been 1,200 units before Office’s order. Home’s capacity is 1,500 units per year. The costs for producing those 1,200 units follow.

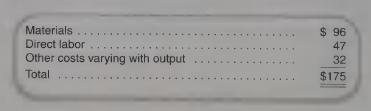

Based on these data, Home’s controller calculated that the unit price for Office’s order should be $720 (= $600 X 120 percent). After producing and shipping the 300 units, Home sent an invoice for $216,000. Shortly thereafter, Home received a note from the buyer at Office stating that this invoice was not in accordance with company policy. The unit cost should have been

The price per unit would be $210 (= $175 X 120 percent).

Required If the corporation asked you to review this intercompany policy, what policy would you recommend?

Why? (Note: You need not limit yourself to the Office or Home Division’s calculation

Step by Step Answer:

Fundamentals Of Cost Accounting

ISBN: 978-0071332613

2nd Edition

Authors: William Lanen, Shannon Anderson