The Gercken Corporation sells computer services to its clients. The company completed a feasibility study and decided

Question:

The Gercken Corporation sells computer services to its clients. The company completed a feasibility study and decided to acquire an additional computer on January 2, 20X5. Information regarding the new computer follows:

1. The purchase price is \(\$ 230,000\). Maintenance, property taxes, and insurance will be \(\$ 20,000\) per year. If the computer is rented, the annual rent will be \(\$ 85,000\) plus 5 percent of annual billings. The rental price includes maintenance. The rent is due on the last day of each year.

2. Due to competitive conditions, the company feels it will be necessary to replace the computer at the end of three years with one which is larger and more advanced. It is estimated that the computer will have a resale value of \(\$ 110,000\) at that time.

3. The income tax rate is 50 percent. If the computer is purchased, sum of-the-years'digits depreciation will be used for tax purposes.

4. The estimated annual billing for the services of the new computer will be \(\$ 220,000\) during the first year and \(\$ 260,000\) during each of the second and third years.

5. The estimated annual expense of operating the computer is \(\$ 80,000\) in addition to the previously mentioned expense. Additional start-up expenses of \(\$ 10,000\) will be incurred during \(20 \times 5\).

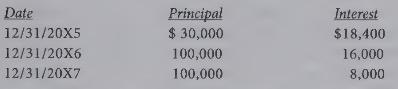

6. If the computer is purchased, the Gercken Corporation will borrow the purchase price from a local bank with interest at 8 percent. The principal and interest will be repaid as follows:

7. The company has a cost of capital of 14 percent.

{Required:}

Should Gercken purchase the computer with borrowed funds or lease it? Round all calculations to the nearest dollar.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline