The economist J. K. Galbraith asserted that fraud rose in a bull market and shrank in a

Question:

The economist J. K. Galbraith asserted that fraud rose in a bull market and shrank in a slump. The discovery of Bernard Madoff’s Ponzi scheme suggests Galbraith may be right about large-scale embezzlement, but my experience is the opposite when it comes to petty larceny. I suspect industry is enduring an epidemic of crime right now, as integrity becomes a casualty of the recession.

At one of our restaurant companies, we have suffered a disturbing rise in insurance claims. This is not because we are careless: we take health and safety seriously. Several of these actions relate to apparent falls by suppliers’ workers, for example. The curious thing is that in more than one case the victim appears to have waited more than 15 months before notifying us of the injury. After talking to other operators, it seems the hospitality trade is suffering a plague of legal letters from claimants looking for free money. No doubt some are genuine; but others are trying it on, I am sure, because they are feeling the pinch, and think negligence claims are easy money. Last year, the Association of British Insurers reported a 17 per cent rise in fraudulent insurance claims. I fear the increase this year will be even greater. Unfortunately, insurers often settle small claims even if they are doubtful, simply to save legal fees and administrative bother. But this policy of expediency only encourages others to try the same con. Similarly, at another retail business we have had trouble with several thefts of large sums of cash from branches this year, all carried out by insiders.

It is very depressing to have to deal with employee dishonesty. One feels a despairing sense of betrayal, especially if senior staff are involved, and too often all that happens to the perpetrators is that they lose their job. As with all such lawless behaviour, these incidents can destroy trust in the workplace, and lead to unhealthy suspicion between owners and staff. The answer is to have excellent systems and thorough checks and balances. But no method of prevention is perfect, and crooks are ingenious at inventing ways round what appears to be foolproof security. In Britain at least, fiddling expenses will never be seen in the same forgiving light after the recent month of political exposés in Westminster. In the wake of the parliamentary scandal, now is the perfect time for organisations to review their staff expense account procedures and stop all abuse in its tracks. Those who cheat on their expenses will find it harder to rationalise their corruption.

I suppose the motivation behind the spike in fraud is obvious. Normally trustworthy people are desperate because they have been living beyond their means, and their income has fallen with the economy. The heightened threat of wrongdoing means business as normal is harder than ever. Vigilance and a proportionate response are required of leaders. Perhaps the most important thing is to avoid slipping into a sense of paranoia, and hope that the vast majority of people are honest, whatever the conditions.

Discussion questions

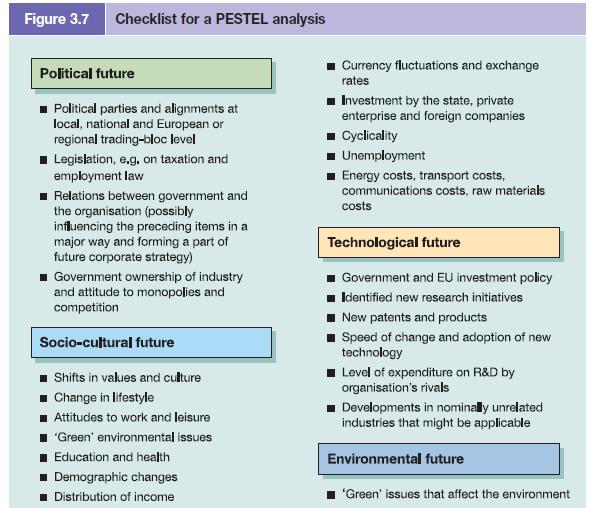

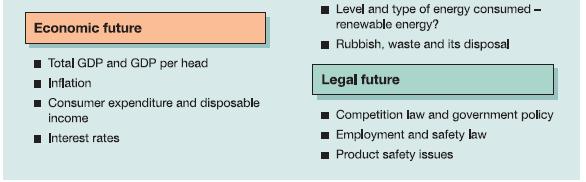

1. Using the checklist for a PESTEL analysis in Figure 3.7 explain the influences which the author believes to be affecting the behaviour of customers and employees.

2. How can managers guard against fraud committed by both customers and staff?

3. What impact do you think both the fraud, and the preventive measures you suggest, are likely to have on levels of organisational conflict and work related stress? Explain your views.

Step by Step Answer:

Management And Organisational Behaviour

ISBN: 9780273728610

9th Edition

Authors: Laurie J. Mullins, Gill Christy