Rayman Company produces three chemical products, J1X, J2Y and B1Z. Raw materials are processed in a single

Question:

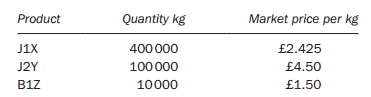

Rayman Company produces three chemical products, J1X, J2Y and B1Z. Raw materials are processed in a single plant to produce two intermediate products, J1 and J2, in fixed proportions. There is no market for these two intermediate products. J1 is processed further through process X to yield the product J1X, product J2 is converted into J2Y by a separate finishing process Y. The Y finishing process produces both J2Y and a waste material, B1, which has no market value. The Rayman Company can convert B1, after additional processing through process Z, into a saleable by-product, B1Z. The company can sell as much B1Z as it can produce at a price of ?1.50 per kg.At normal levels of production and sales, 600 000kg of the common input material are processed each month. There are 440 000 kg and 110 000 kg respectively, of the intermediate products J1 and J2, produced from this level of input. After the separate finishing processes, fixed proportions of J1X, J2Y and B1Z emerge, as shown below with current market prices (all losses are normal losses):

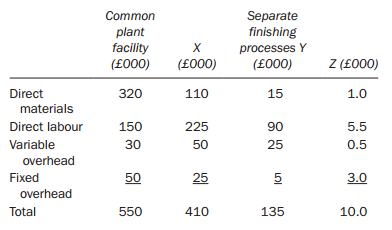

At these normal volumes, materials and processing costs are as follows:

Selling and administrative costs are entirely fixed and cannot be traced to any of the three products.

Required:(a) Draw a diagram that shows the flow of these products, through the processes, label the diagram and show the quantities involved in normal operation.(b) Calculate the cost per unit of the finished products J1X and J2Y and the total manufacturing profit, for the month, attributed to each product assuming all joint costs are allocated based on:(i) Physical units.(ii) Net realizable value. and comment briefly on the two methods. NB All losses are normal losses.(c) A new customer has approached Rayman wishing to purchase 10 000 kg of J2Y for ?4.00 per kg. This is extra to the present level of business indicated above.?

Advise the management how they may respond to this approach by:(i) Developing a financial evaluation of the offer.(ii) Clarifying any assumptions and further questions that may apply.

Step by Step Answer: