Question: Robust Laptops Co. (RL) make laptop computers for use in dangerous environments.The company?s main customers are organizations like oil companies and the military that require

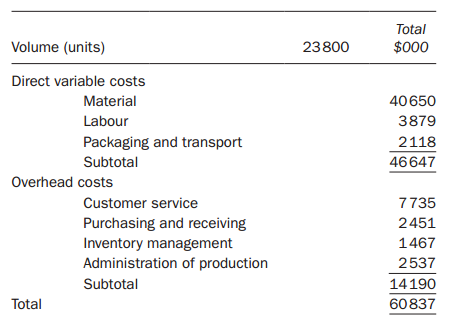

Robust Laptops Co. (RL) make laptop computers for use in dangerous environments.The company?s main customers are organizations like oil companies and the military that require a laptop that can survive rough handling in transport to a site and can be made to their unique requirements.The company started as a basic laptop manufacturer but its competitors grew much larger and RL had to find a niche market where its small size would not hinder its ability to compete. It is now considered one of the best quality producers in this sector.RL had the same finance director for many years who preferred to develop its systems organically. However, due to fall in profitability, a new chief executive officer (CEO) has been appointed who wishes to review RL?s financial control systems in order to get better information with which to tackle the profit issue.The CEO wants to begin by thinking about the pricing of the laptops to ensure that selling expensive products at the wrong price is not compromising profit margins. The laptops are individually specified by customers for each order and pricing has been on a production cost plus basis with a mark-up of 45 percent. The company uses an absorption costing system based on labour hours in order to calculate the production cost per unit.The main control system used within the company is the annual budget. It is set before the start of the financial year and variances are monitored and acted on by line managers.The CEO has been reading about major companies that have stopped using budgets and wants to know how such a radical move works and why a company might take such a step. He has been worried by moves by competitors into RL?s market with impressive new products. This has created unrest among the staff at RL with two experienced managers leaving the company.Financial and other information for Robust Laptops Data for the year ended 30 September

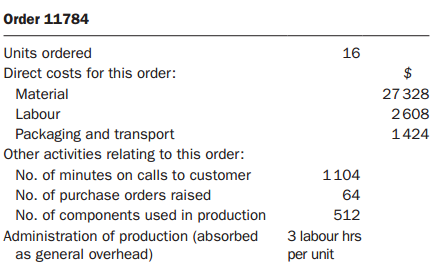

Labour time per unit ...........................................3 hoursData collected for the year:No. of minutes on calls to customer ..................899 600No of purchase orders raised .............................21 400No of components used in production ..............618 800

Required:Write a report to the CEO to include:(a) An evaluation of the current method of costing against an activity-based costing (ABC) system. You should provide illustrative calculations using the information provided on the above costs and Order 11 784. Briefly state what action management might take in the light of your results with respect to this order.(b) An explanation of the operation of a beyond budgeting approach and an evaluation of the potential of such a change at RL.

Total $000 Volume (units) 23800 Direct variable costs Material 40650 3879 Labour Packaging and transport 2118 Subtotal 46647 Overhead costs Customer service 7735 2451 Purchasing and receiving Inventory management Administration of production 1467 2537 Subtotal 14190 Total 60837 Order 11784 Units ordered 16 Direct costs for this order: Material 27 328 Labour 2608 Packaging and transport 1424 Other activities relating to this order: No. of minutes on calls to customer 1104 No. of purchase orders raised No. of components used in production Administration of production (absorbed as general overhead) 64 512 3 labour hrs per unit 24

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

a An evaluation of the current method of costing against an activity based costing ABC system The current method of costing used by RL is an absorption costing system based on labour hours This system ... View full answer

Get step-by-step solutions from verified subject matter experts