Question: An entrepreneur wants to release a new product: beer gum, a non-alcoholic chewing gum that tastes like beer. However, this entrepreneur only has funds

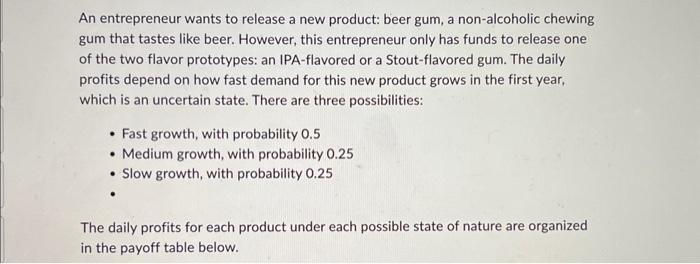

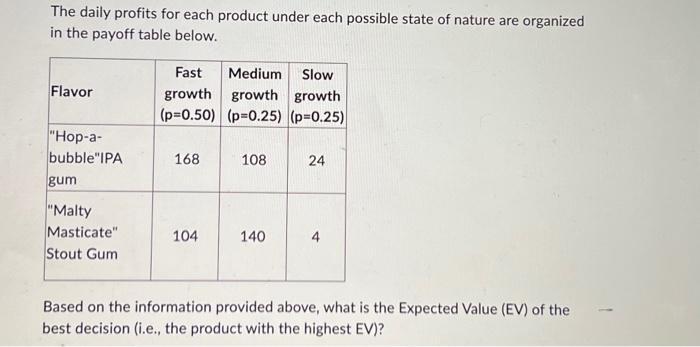

An entrepreneur wants to release a new product: beer gum, a non-alcoholic chewing gum that tastes like beer. However, this entrepreneur only has funds to release one of the two flavor prototypes: an IPA-flavored or a Stout-flavored gum. The daily profits depend on how fast demand for this new product grows in the first year, which is an uncertain state. There are three possibilities: Fast growth, with probability 0.5 Medium growth, with probability 0.25 Slow growth, with probability 0.25 The daily profits for each product under each possible state of nature are organized in the payoff table below. The daily profits for each product under each possible state of nature are organized in the payoff table below. Flavor "Hop-a- bubble"IPA gum "Malty Masticate" Stout Gum Fast Medium Slow growth growth growth (p=0.50) (p=0.25) (p=0.25) 168 104 108 140 24 4 Based on the information provided above, what is the Expected Value (EV) of the best decision (i.e., the product with the highest EV)?

Step by Step Solution

3.55 Rating (166 Votes )

There are 3 Steps involved in it

To calculate the expected value EV for each flavor prototype we need to multiply the profit for each ... View full answer

Get step-by-step solutions from verified subject matter experts