Anand Limited manufactures drones for industrial use. Most of their costs are either true variable costs or

Question:

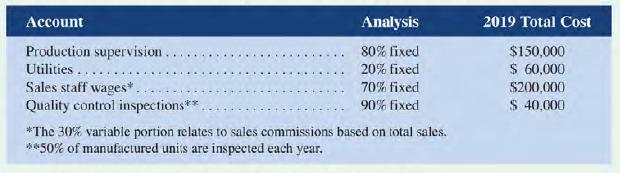

Anand Limited manufactures drones for industrial use. Most of their costs are either true variable costs or fixed costs. However, an account analysis shows the following items are mixed costs.

In 2019 Anand Limited produced and sold 500 drones at $2,000 each.

Required:

1. Management expects to sell 700 drones in 2020, does not anticipate any cost increases due to inflation, and plans to maintain the sales price of $2,000 per drone. Estimate total costs for each of the mixed cost items above. Be sure to show the variable and fixed components of the total cost.

2. In addition to the facts per requirement 1, assuming that direct material costs are $500 per unit and direct labour costs are $250 per unit, calculate the expected contribution margin for 2020 based on sales of 700 drones.

Step by Step Answer:

Managerial Accounting

ISBN: 9781260193275

12th Canadian Edition

Authors: Ray H. Garrison, Alan Webb, Theresa Libby