Oil Field Equipment Company is a small company that manufactures specialty heavy equipment for use in Alberta

Question:

Oil Field Equipment Company is a small company that manufactures specialty heavy equipment for use in Alberta oil-fields. The company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the direct labour-hours. At the beginning of the current year, the following estimates were made to compute the predetermined overhead rate: manufacturing overhead cost, $360,000, and 900 direct labour-hours. The following transactions took place during the year (all purchases and services were acquired on account):

a. Raw materials were purchased for use in production: $200,000.

b. Raw materials were requisitioned for use in production (all direct materials): $185,000.

c. Utility bills were incurred in the factory : $70,000 (90% related to factory operations and the remaining related to administrative activities).

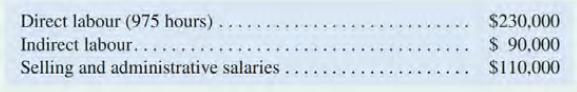

d. Costs for salaries and wages were incurred as follows:

e. Maintenance costs were incurred in the factory: $54,000.

f. Advertising costs were incurred: $136,000.

g. Depreciation was recorded for the year: $95,000 (80% relates to factory assets, and the remainder relates to selling and administrative equipment).

h. Rental cost was incurred on buildings: $120,000 (85% of the space is occupied by the factory, and the remainder is related to sell ing and administration facilities).

i. Manufacturing overhead cost was applied to jobs: $ _ ?

j. Cost of goods manufactured for the year was $770,000.

k. Sales for the year (all on account) totalled $1,200,000. These goods cost $800,000 according to their job cost sheets.

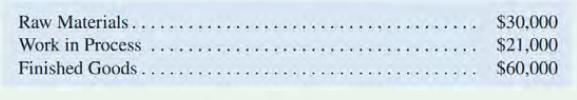

The balances in the inventory accounts at the beginning of the year were as follows:

Required:

1. Prepare journal entries to record the above data.

2. Post your entries to T-accounts. (Don't forget to enter the opening inventory balances above.) Determine the ending balances in the inventory accounts and in the Manufacturing Overhead account.

3. Prepare a schedule of cost of goods manufactured.

4. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. Prepare a schedule of cost of goods sold.

5. Prepare an income statement for the year.

6. Job 412 was one of many jobs started and completed during the year. The job required $8,000 in direct materials and 39 hours of direct labour time at a total direct labour cost of $9,200. The job contained only four units. If the company billed at a price of 60% above the unit product cost on the job cost sheet, what price per unit would have been charged to the customer?

Step by Step Answer:

Managerial Accounting

ISBN: 9781260193275

12th Canadian Edition

Authors: Ray H. Garrison, Alan Webb, Theresa Libby