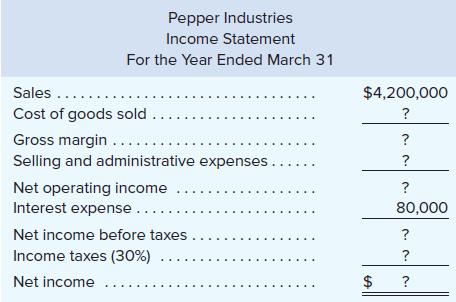

Incomplete financial statements for Pepper Industries follow: Pepper Industries Income Statement For the Year Ended March 31

Question:

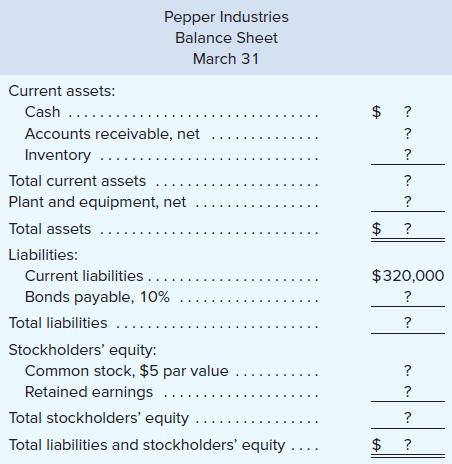

Incomplete financial statements for Pepper Industries follow:

Pepper Industries

Income Statement

For the Year Ended March 31

The following additional information is available about the company:

a. All sales during the year were on account.

b. There was no change in the number of shares of common stock outstanding during the year.

c. The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change during the year.

d. Selected balances at the beginning of the current year were:

Accounts receivable . . . . . . . . . . . . . . . . . . . . . . $270,000

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $360,000

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,800,000

e. Selected financial ratios computed from the statements above for the current year are:

Earnings per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2.30

Debt-to-equity ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.875

Accounts receivable turnover . . . . . . . . . . . . . . . . . . . . . 14.0

Current ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.75

Return on total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.0%

Times interest earned ratio . . . . . . . . . . . . . . . . . . . . . . 6.75

Acid-test ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.25

Inventory turnover . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.5

Required:

Compute the missing amounts on the company’s financial statements.

Step by Step Answer:

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer