Refer to the data in Exercise 16-2 for Weller Corporation. Data From Exercise 16-2 : Comparative financial

Question:

Refer to the data in Exercise 16-2 for Weller Corporation.

Data From Exercise 16-2 :

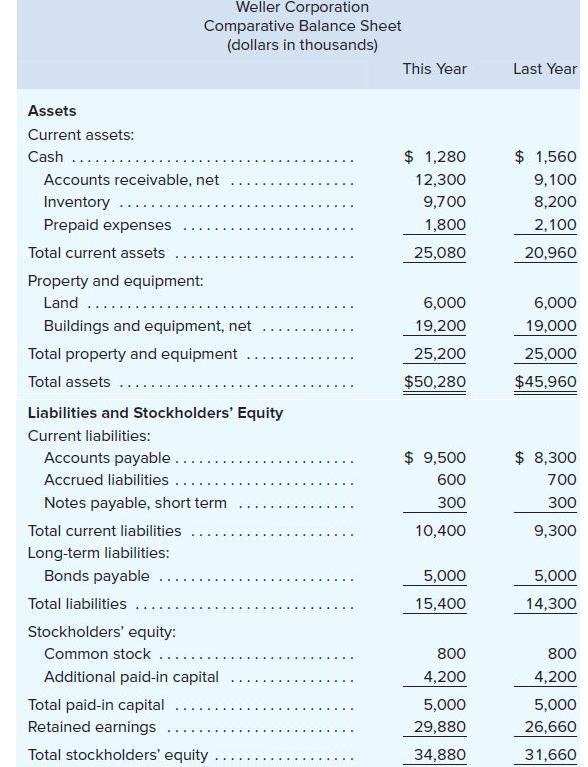

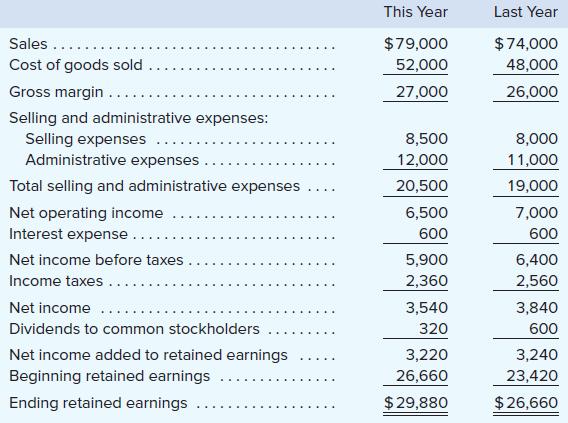

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 800,000 shares of common stock were outstanding. The interest rate on the bond payable was 12%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company’s common stock at the end of this year was $18. All of the company’s sales are on account.

Weller Corporation

Comparative Income Statement and Reconciliation

(dollars in thousands)

Required:

Compute the following financial ratios for this year:

1. Times interest earned ratio.

2. Debt-to-equity ratio.

3. Equity multiplier.

Step by Step Answer:

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer