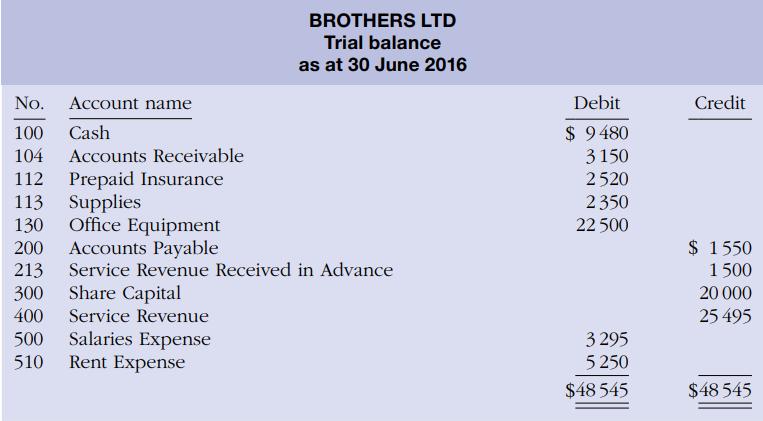

Brothers Ltd began operations on 1 February 2016. The trial balance at 30 June is as follows.

Question:

Brothers Ltd began operations on 1 February 2016. The trial balance at 30 June is as follows.

In addition to those accounts listed on the trial balance, the chart of accounts for Brothers Ltd also contains the following accounts: 131 Accumulated Depreciation—Office Equipment, 218 Electricity Payable, 215 Salaries Payable, 520 Depreciation Expense, 515 Insurance Expense, 530 Electricity Expense, and 505 Supplies Expense.

Other data:

1. Supplies on hand at 30 June total $490.

2. An electricity bill for $110 has not been recorded and will not be paid until next month.

3. The insurance policy is for a year, commencing 1 February 2016.

4. Services were performed during the period in relation to $800 of Revenue Received in Advance.

5. Salaries of $770 are owed at 30 June.

6. The office equipment has a 5-year life with no resale value and is being depreciated at $375 per month for 60 months.

7. Invoices representing $1500 of services performed during the month have not been recorded as of 30 June.

Required

(a) Prepare the adjusting entries for the month of June.

(b) Using T accounts, enter the totals from the trial balance as beginning account balances and then post the adjusting entries to the ledger accounts.

(c) Prepare an adjusted trial balance as at 30 June 2016.

(d) If the business wanted to report a higher profit which of the adjusting entries would be avoided? Which stakeholders would be affected by the misreported profit?

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong