In recent years Button Ltd has purchased three machines. Because of frequent employee turnover in the accounting

Question:

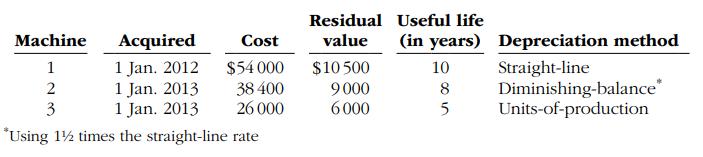

In recent years Button Ltd has purchased three machines. Because of frequent employee turnover in the accounting department, a different accountant was in charge of selecting the depreciation method for each machine, and various methods have been used. Information concerning the machines is summarised in the table below.

For the units-of-production method, total machine hours are expected to be 10 000. Actual hours of use in the first 3 years were: 2013, 1000; 2014, 3000; and 2015, 4000.

Required

(a) Calculate the amount of accumulated depreciation on each machine at 31 December 2015.

(b) For Machine 3 in 2015, which depreciation method is the preferred method for tax purposes? Explain why.

(c) If you are the manager of Button Ltd and your bonus is linked to profit of the company, which depreciation method do you prefer for Machine 3 in 2015? Explain why in point form.

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong