Question: Presented below is basic financial information from recent annual reports of Qantas and Air New Zealand: Required (a) Calculate the receivables turnover and average collection

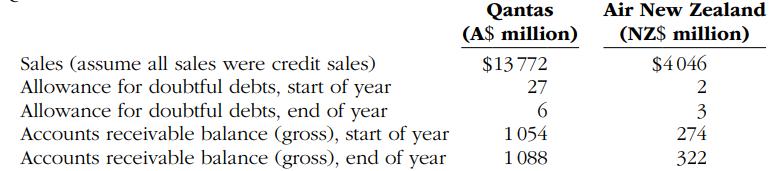

Presented below is basic financial information from recent annual reports of Qantas and Air New Zealand:

Required

(a) Calculate the receivables turnover and average collection period for both entities. Comment on the difference in their collection experiences.

(b) Calculate the ratio of allowance for doubtful debts to gross accounts receivable (credit risk ratio) for each entity for the start of the year and at the end of the year. Comment on any apparent differences in their credit-granting practices.

Sales (assume all sales were credit sales) Allowance for doubtful debts, start of year Allowance for doubtful debts, end of year Accounts receivable balance (gross), start of year Accounts receivable balance (gross), end of year Qantas (A$ million) $13772 27 6 1054 1088 Air New Zealand (NZ$ million) $4046 2 3 274 322

Step by Step Solution

3.35 Rating (170 Votes )

There are 3 Steps involved in it

a Qantas Receivables Turnover Sales Accounts Receivable 13772 1054 1309 Average Collection Period 36... View full answer

Get step-by-step solutions from verified subject matter experts