You are a loan officer at Corporate Bank. Penny Wise, manager of Leverage Ltd, is interested in

Question:

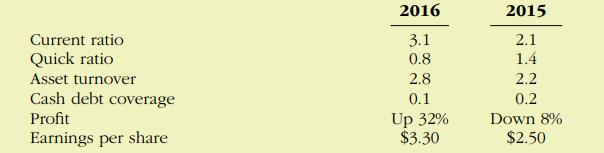

You are a loan officer at Corporate Bank. Penny Wise, manager of Leverage Ltd, is interested in a 5-year loan to expand the entity’s operations. The borrowed funds would be used to purchase new equipment. As evidence of Leverage Ltd’s debt-worthiness, Penny provided you with the following facts.

When you told Penny that you would need additional information before making your decision, she was offended, and said, ‘What more could you possibly want to know?’ You responded that, as a minimum, you would need complete, audited financial statements.

Required

With the class divided into groups, answer the following:

(a) Explain why you would want the financial statements to be audited.

(b) Discuss the implications of the ratios provided for the lending decision you are to make. Does the information paint a favourable picture? Are these ratios relevant to the decision?

(c) List three other ratios that you would want to calculate for Leverage Ltd, and explain why you would use each.

(d) What are the limitations of ratio analysis for credit and investing decisions?

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong